Budgeting is one of the most important life skills, yet many of us don’t pay attention to it until it’s too late. Your 20s and 30s are the years when you start earning, gaining financial independence, and making decisions that will affect your future. The habits you build during this time can either help you achieve financial freedom or push you into years of stress and debt.

Unfortunately, many young adults make common mistakes with money. The good news is that these mistakes are avoidable. By learning about them early, you can build stronger financial habits and create a stable future.

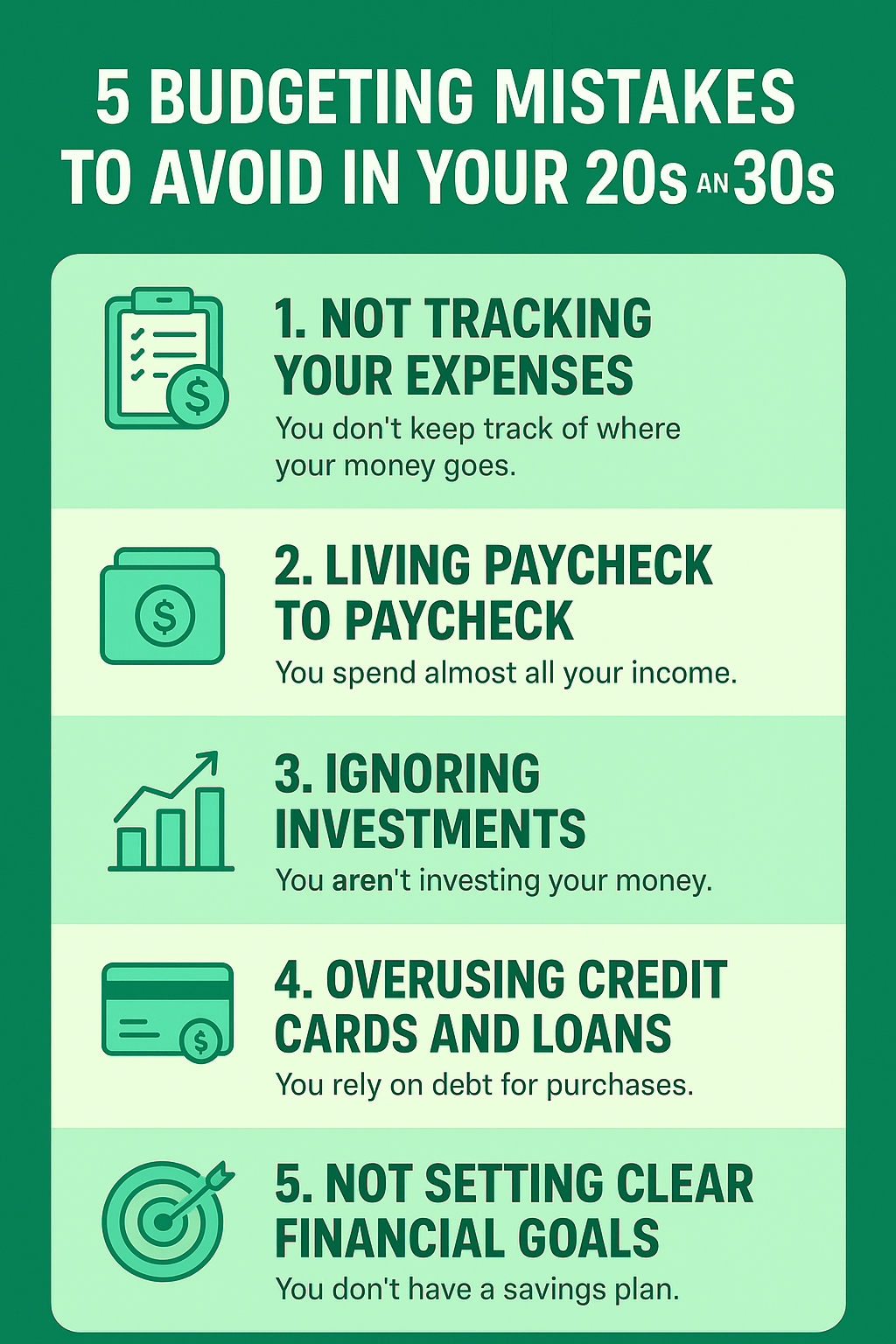

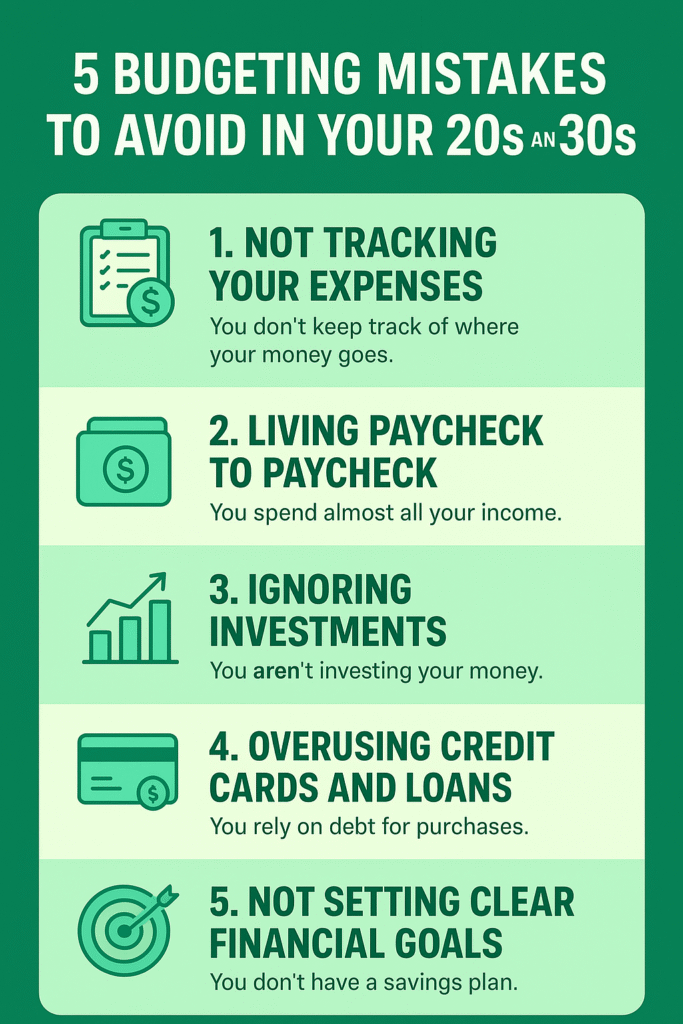

Here are 5 budgeting mistakes to avoid in your 20s and 30s.

Table of Contents

1. Not Tracking Your Expenses

One of the biggest mistakes young people make is not keeping track of where their money goes. You might feel like you’re not spending too much, but when you actually write it down or check your bank statement, you realize small expenses add up.

For example, a daily coffee for ₹200 may seem harmless. But if you buy it five days a week, that’s ₹1,000 a week and over ₹4,000 a month. Add in food deliveries, online subscriptions, or impulse shopping, and suddenly a big part of your income disappears.

Without tracking your expenses, you’ll never know where your money is leaking.

How to fix it:

- Use simple apps or even a notebook to record expenses.

- Categorize your spending: food, rent, entertainment, shopping, travel.

- Review your expenses weekly or monthly.

Once you start tracking, you’ll see patterns and know exactly where you can cut back.

2. Living Paycheck to Paycheck

Many people in their 20s and 30s spend almost everything they earn. As soon as the salary comes in, they pay bills, go shopping, eat out, and by the end of the month, there’s nothing left. This habit is called “living paycheck to paycheck.”

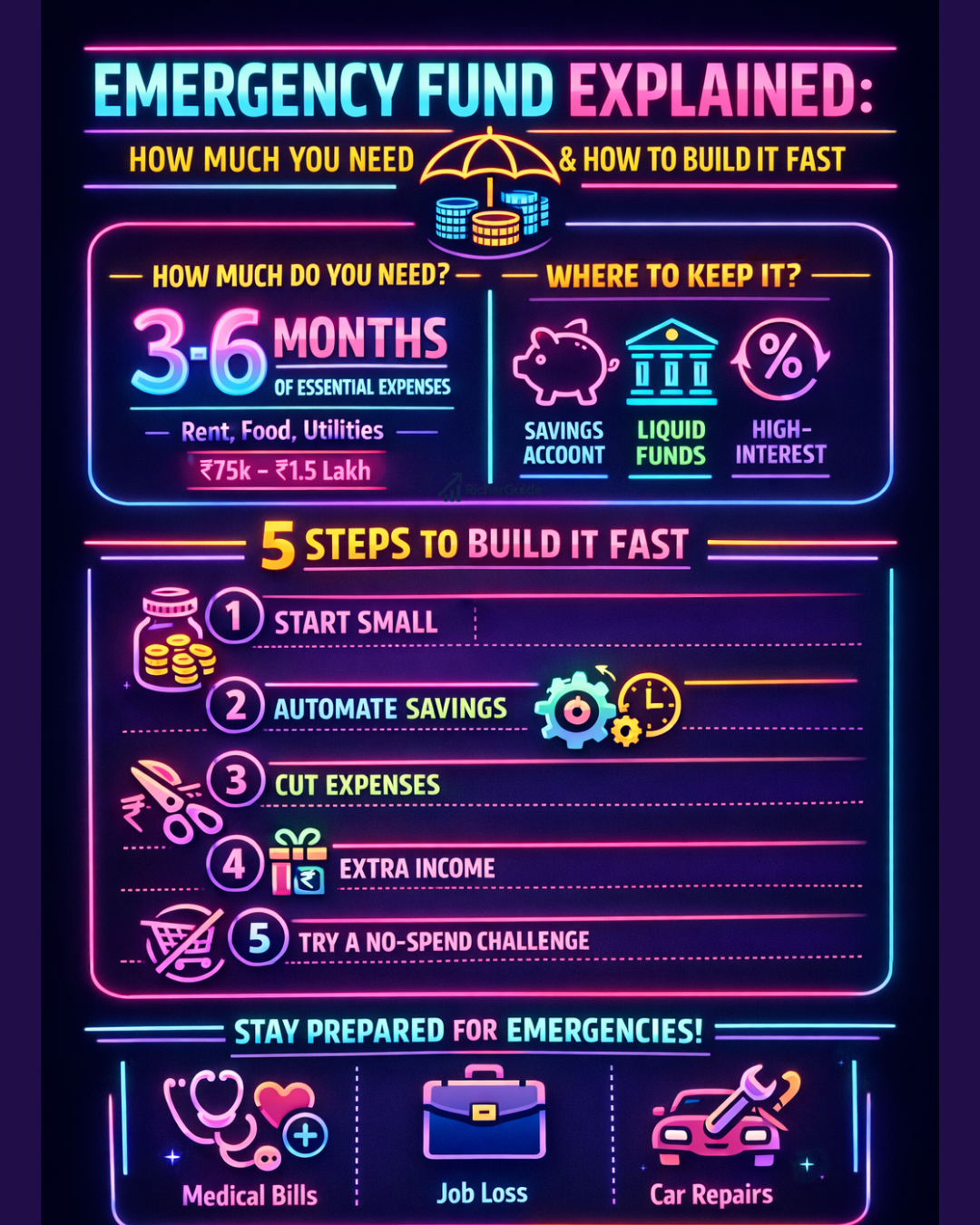

The danger with this lifestyle is that it leaves you with no savings. If an emergency happens, like a medical bill or job loss, you’ll have no backup. You may end up depending on credit cards or loans, which only make things worse.

How to fix it:

- Follow a simple rule like the 50-30-20 method: spend 50% of your income on needs, 30% on wants, and save at least 20%.

- Build an emergency fund with at least 3–6 months of living expenses.

- Start small if needed. Even saving ₹2,000–₹5,000 a month adds up over time.

Remember, saving money is not about how much you earn but how much you keep aside.

3. Ignoring Investments

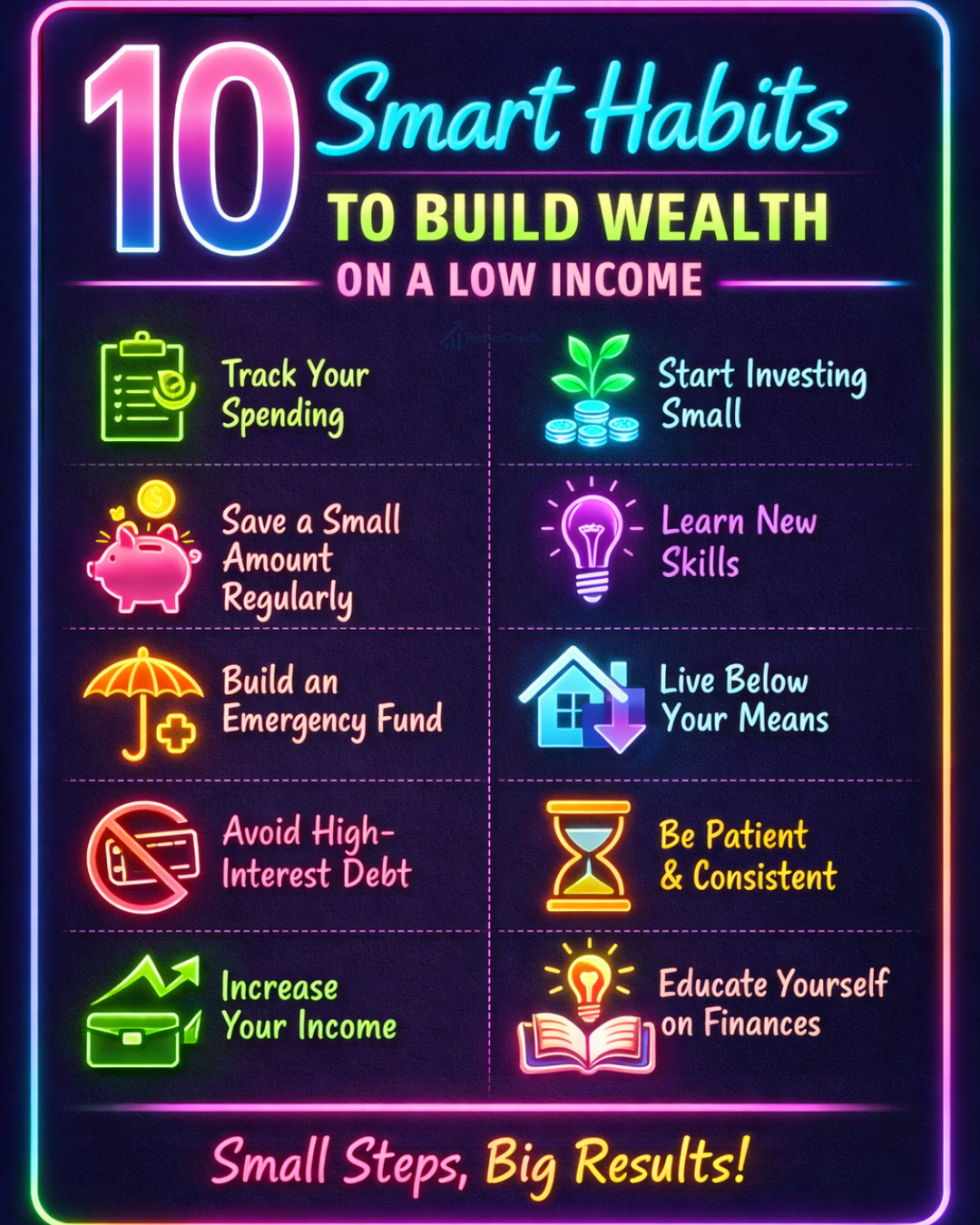

In your 20s and 30s, retirement or long-term wealth may feel far away. Many young adults think they’ll start investing later when they earn more. But waiting too long is one of the costliest mistakes.

The earlier you invest, the more time your money has to grow through compound interest. For example, if you invest ₹5,000 a month at age 25 and get an average return of 12% per year, by age 55 you’ll have more than ₹1.7 crore. If you wait until 35 to start, you’ll end up with less than half that amount.

How to fix it:

- Start small but start early. Even ₹1,000–₹2,000 per month matters.

- Learn about different options like mutual funds, stocks, bonds, or retirement accounts.

- Automate your investments so money is deducted before you spend it.

Your 20s and 30s are the best time to let your money work for you.

4. Overusing Credit Cards and Loans

Credit cards are convenient, but they can easily become a trap if not managed wisely. Many people swipe their cards for shopping, dining, or vacations without realizing how quickly debt piles up. Loans for gadgets, holidays, or luxury purchases are also common, but they burden you with high interest.

The problem is not the card itself but how it is used. If you only pay the minimum balance, the interest keeps growing, and you may find yourself in a debt cycle.

How to fix it:

- Use credit cards only for planned purchases, not impulse buys.

- Always pay the full balance on time to avoid interest.

- Limit the number of loans you take. Only borrow for assets that add value, like education or a home.

Debt can slow down your financial growth. The less you owe, the faster you can save and invest.

5. Not Setting Clear Financial Goal

Many people in their 20s and 30s live without a plan for their money. They spend what they earn without thinking about the future. Without goals, it’s hard to stay motivated to save or invest.

For example, you may want to buy a car in 2 years, travel abroad in 3 years, or buy a house in 7 years. If you don’t plan for these, you might end up using loans or credit, which creates financial stress.

How to fix it:

- Write down short-term goals (1–3 years), medium-term goals (3–7 years), and long-term goals (7+ years).

- Create a budget that supports these goals.

- Review your goals regularly and adjust your budget as life changes.

When you have clear goals, budgeting becomes easier because you know what you’re working toward.

Final Thoughts

Your 20s and 30s are exciting years filled with new opportunities, freedom, and growth. But they’re also the time when money mistakes can follow you for decades. By avoiding these five budgeting mistakes—not tracking expenses, living paycheck to paycheck, ignoring investments, overusing credit, and not setting goals. you can set yourself up for financial security and peace of mind.

Budgeting doesn’t mean restricting yourself from enjoying life. It simply means making smarter choices with your money. Start small, be consistent, and remember that every good financial habit you build today will reward you in the future.

Smart Types of Investments | Beginner’s Guide to Stocks, Bonds, Real Estate and Crypto Currency!