Life is full of surprises. Some are good, but many are expensive. A sudden job loss, medical emergency, car repair, or urgent home expense can happen at any time. This is why an emergency fund is one of the important money habits you can build.

An emergency fund gives you peace of mind. It protects you from debt and helps you stay financially stable during tough times. In this blog, we will explain what an emergency fund is, how much you really need, and how you can build it fast even with a low income.

Table of Contents

What Is an Emergency Fund?

An emergency fund is money you save only for unexpected expenses. It is not for shopping, travel, or regular bills. This money is kept aside to help you handle emergencies without using credit cards or loans.

Common emergencies include:

Having a financial cushion is crucial for stability.

- Medical bills

- Job loss or pay cut

- Car or bike repair

- Urgent home repairs

- Family emergencies

Think of an emergency fund as your financial safety net. When something goes wrong, this fund catches you.

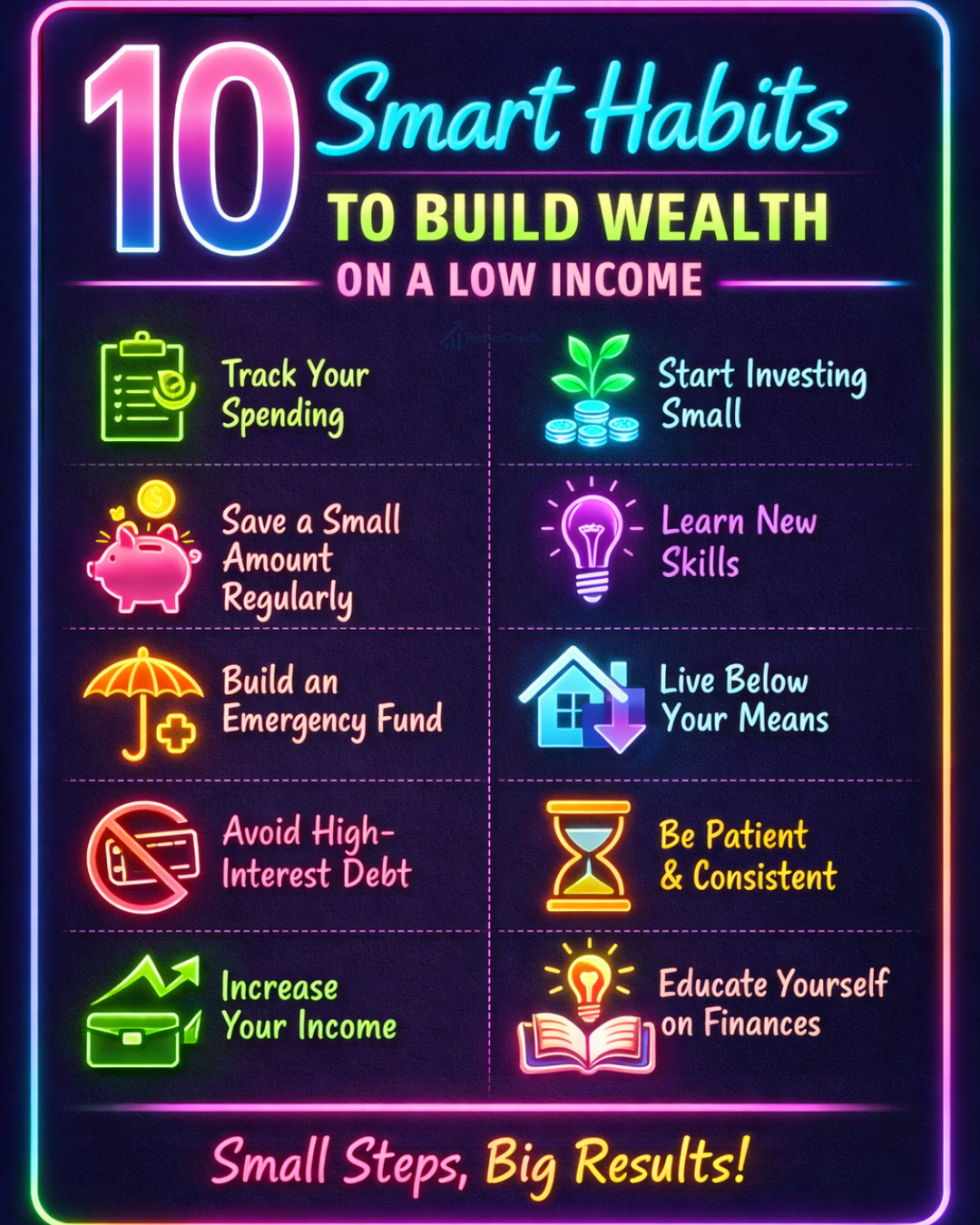

Why Is an Emergency Fund So Important?

Many people ignore emergency savings because they feel it is not urgent. But emergencies do not come with a warning.

Here’s why an emergency fund matters:

- It keeps you out of debt

- It reduces stress and anxiety

- It gives you time to make better decisions

- It protects your long-term savings and investments

Without an emergency fund, one unexpected expense can destroy months or years of financial progress.

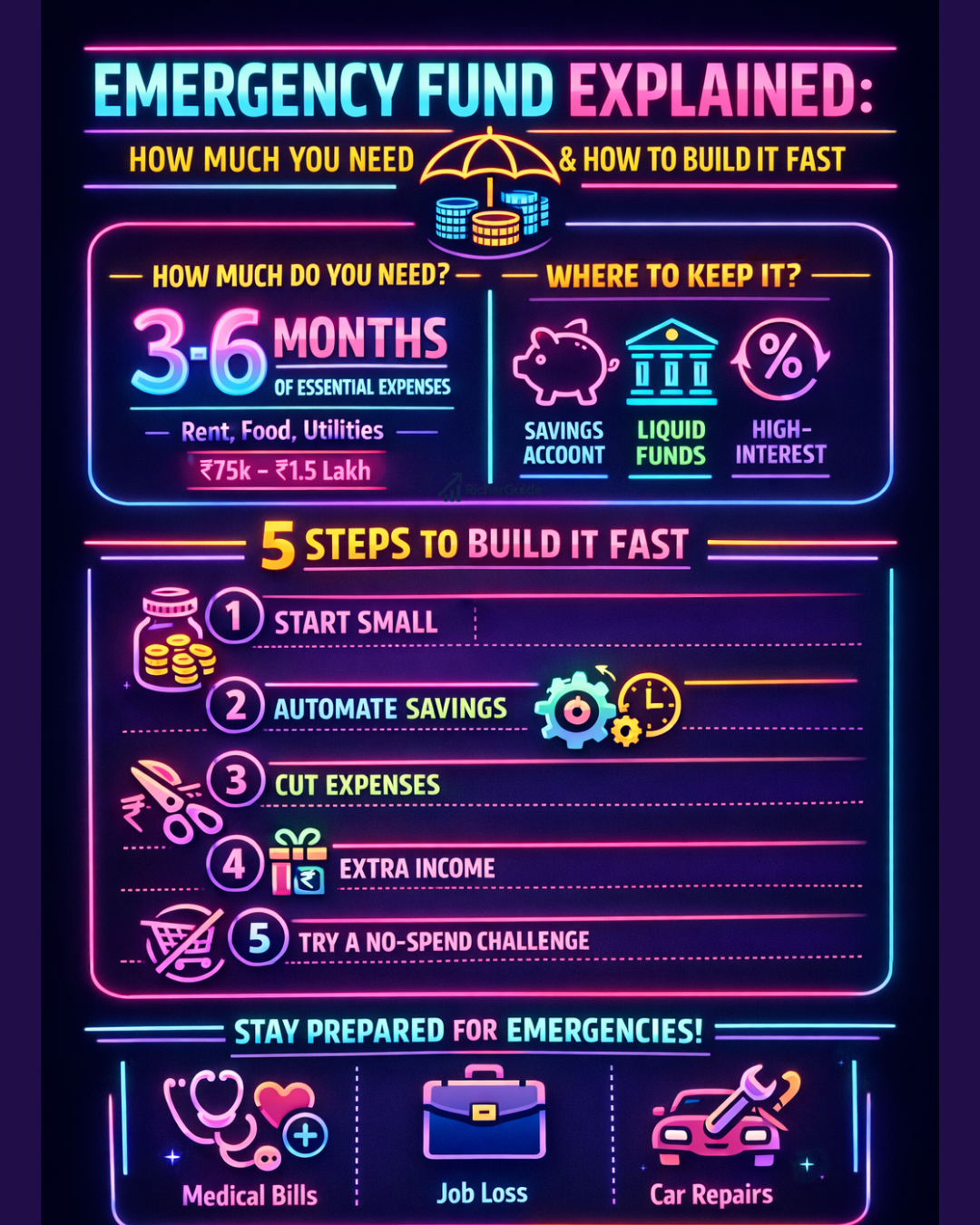

How Much Emergency Fund Do You Need?

The right amount depends on your lifestyle, income, and responsibilities. But there is a simple rule that works for most people.

The 3–6 Months Rule

You should save 3 to 6 months of essential expenses.

Essential expenses include:

- Rent or home loan

- Food and groceries

- Utilities (electricity, water, internet)

- Transport

- Insurance premiums

For example:

If your monthly essential expenses are ₹25,000:

- 3 months = ₹75,000

- 6 months = ₹1,50,000

Start with 3 months first. Once that is done, aim for 6 months.

Who Needs a Bigger Emergency Fund?

You should aim for 6 months or more if:

- You are self-employed or a freelancer

- Your income is irregular

- You have dependents

- You work in an unstable job sector

If you have a stable job and multiple income sources, 3–4 months may be enough.

Where Should You Keep Your Emergency Fund?

Your emergency fund should be:

- Easy to access

- Safe

- Not affected by market ups and downs

Best options:

- Savings account

- High-interest savings account

- Liquid mutual funds

Avoid keeping emergency money in:

- Stocks

- Crypto

- Long-term investments

- Fixed assets like gold or real estate

You need this money fast, not after waiting or selling at a loss.

How to Build an Emergency Fund

Building an emergency fund may feel difficult, but it is possible with the right steps.

1. Start Small

Do not wait to save a big amount. Start with a small goal like ₹10,000 or ₹25,000. Small wins keep you motivated.

2. Automate Your Savings

Set up an automatic transfer to your emergency fund account every month. Treat it like a bill you must pay.

Even ₹1,000–₹2,000 per month makes a difference.

3. Cut Unnecessary Expenses

Review your spending. Cancel unused subscriptions, reduce eating out, and avoid impulse buying. Redirect that money to your emergency fund.

4. Use Extra Income

Whenever you get:

- Bonus

- Tax refund

- Gift money

- Side income

Put at least a part of it into your emergency fund.

5. Try a No-Spend Challenge

Choose one month where you spend only on essentials. The money you save can go straight into your emergency fund.

How Long Does It Take to Build an Emergency Fund?

There is no fixed time. It depends on your income and savings rate.

Example:

If you save ₹5,000 per month:

- ₹60,000 fund = 12 months

If you save ₹10,000 per month:

- ₹1,20,000 fund = 12 months

The key is consistency, not speed.

Common Emergency Fund Mistakes to Avoid

- Using emergency money for shopping or travel

- Keeping it locked in long-term investments

An emergency fund only works if you respect its purpose.

What to Do After Your Emergency Fund Is Ready

Once your emergency fund is complete:

- Start investing for long-term goals

- Build sinking funds for planned expenses

- Increase insurance coverage if needed

Your emergency fund becomes the strong base of your financial life.

Final Thoughts

An emergency fund is not optional it is essential. It gives you freedom, confidence, and financial security. You do not need to be rich to start. You just need to start.

Build it slowly, protect it carefully, and use it wisely. Your future self will thank you.