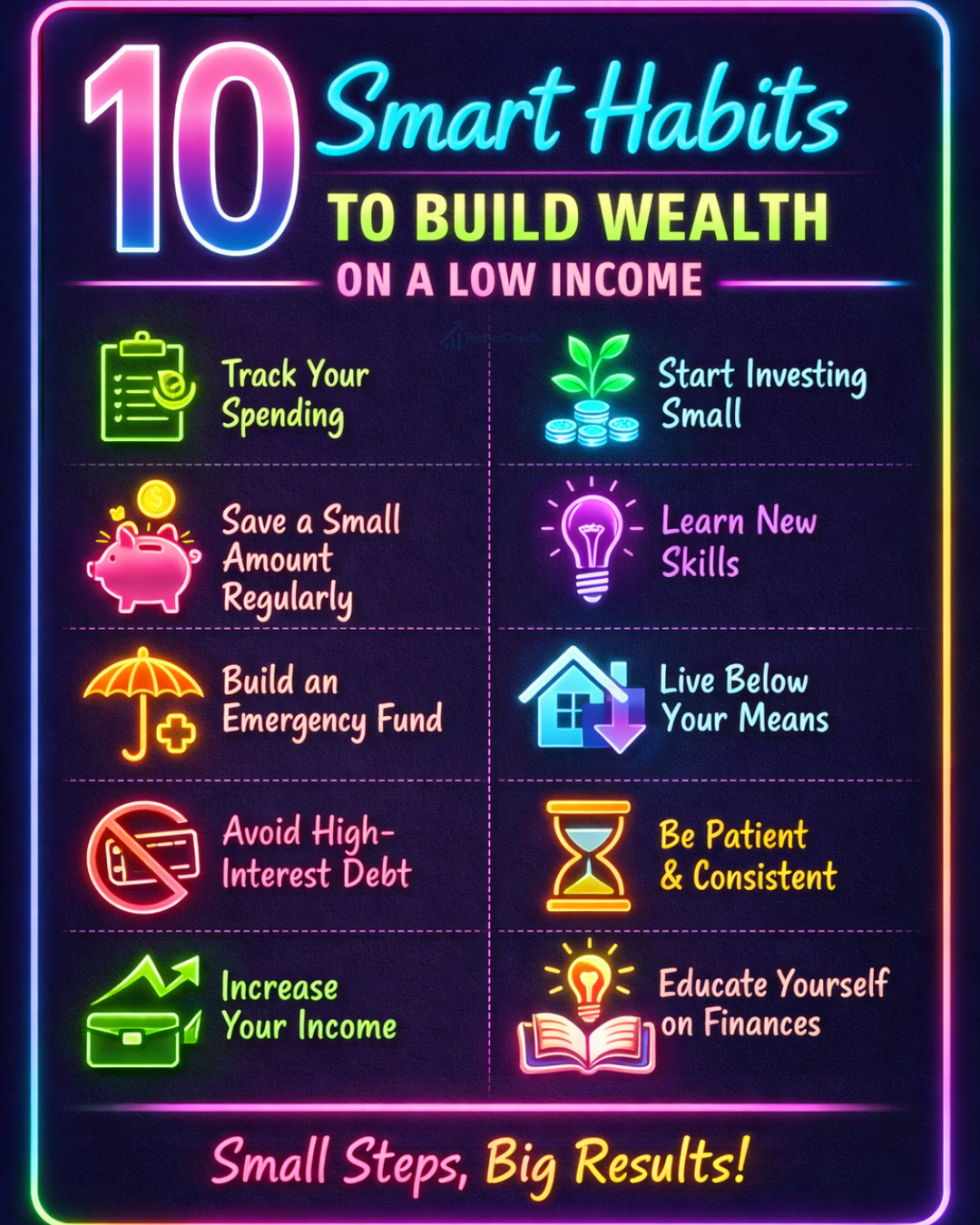

In 2026, getting rich is no longer only about earning a very high salary. Many people with normal incomes are building wealth faster than ever. How?

They are following modern money habits that focus on smart systems, automation, the right mindset, and useful digital tools. These money habits are essential for financial success.

The truth is simple:

Your daily habits matter more than your income.

Let’s look at the money habits that are helping people become richer in 2026 and how you can start using them today.

These money habits emphasize the importance of financial education and long-term thinking.

Table of Contents

1. Automating Their Savings First

The key money habits include saving automatically and investing wisely.

One of the biggest habits of wealthy people in 2026 is saving automatically.

Instead of saving money only if something is left at the end of the month, people now:

- Set up automatic transfers

- Save money the moment they get paid

This habit removes emotions and excuses. The money goes directly into savings or investment accounts before it can be spent.

These money habits help individuals avoid unnecessary stress and build a secure financial future.

Many people use:

- Auto bank transfers

- Salary split features

- Saving apps that round up spending

This simple habit builds wealth quietly in the background.

2. Investing Small Amounts Regularly

In 2026, investing is no longer scary or expensive.

People are getting richer by:

- Investing small amounts every week or month

- Using SIPs, micro-investing, and fractional investing

- Staying invested for the long term

Investing regularly is one of the most effective money habits to generate wealth.

They understand that time in the market is more powerful than timing the market.

Even investing a small amount consistently can grow into a big sum over the years because of compounding.

3. Using Smart Money Apps and Tools

Technology is playing a huge role in money growth in 2026.

Smart people use tools that:

- Track expenses automatically

- Show spending patterns

- Send reminders for bills and investments

- Help set financial goals

Popular tools include:

- Budgeting apps

- Investment dashboards

- AI-based finance assistants

Using smart tools is a crucial part of these money habits.

These tools save time and reduce mistakes, making money management easier and smarter.

4. Tracking Spending Without Stress

Rich people in 2026 don’t obsess over every small expense but they know where their money goes.

They:

- Review spending weekly or monthly

- Cut unnecessary expenses

- Avoid lifestyle inflation

Instead of strict budgeting, they follow smart spending awareness.

This habit helps them save more without feeling restricted or guilty.

5. Building Multiple Income Streams

Relying on just one income source is risky in today’s world.

That’s why many people in 2026 are:

- Creating side incomes

- Freelancing online

- Earning from digital products

- Investing in dividend-paying assets

Even a small second income helps:

- Increase savings

- Reduce financial stress

- Speed up wealth building

Tracking expenses is one of the best money habits you can adopt.

Multiple income streams give people more control over their future.

6. Focusing on Long-Term Mindset, Not Quick Wins

One major habit that separates rich people from others is their money mindset.

In 2026, wealthy people:

- Think long-term

- Avoid get-rich-quick schemes

- Focus on steady growth

They understand that:

- Wealth takes time

- Consistency beats shortcuts

- Patience pays off

This mindset helps them stay calm during market ups and downs and stick to their plans.

7. Learning About Money Regularly

Diversifying income sources is one of the most powerful money habits.

Financial education is no longer optional it’s a habit.

People who are getting richer in 2026:

- Read finance blogs

- Watch money-related videos

- Follow trusted financial creators

- Learn basic investing and saving rules

They don’t try to become experts overnight.

They learn a little every week and improve over time.

This habit helps them make smarter money decisions.

8. Avoiding Bad Debt and Using Credit Smartly

Rich people don’t hate credit but they use it wisely.

In 2026, smart money habits include:

- Paying credit card bills in full

- Avoiding high-interest loans

- Using credit for rewards, not lifestyle

They see debt as a tool, not free money.

This habit protects them from financial stress and unnecessary interest payments.

9. Setting Clear Financial Goals

People are getting richer because they know what they are working toward.

These money habits encourage personal growth and financial literacy.

They set goals like:

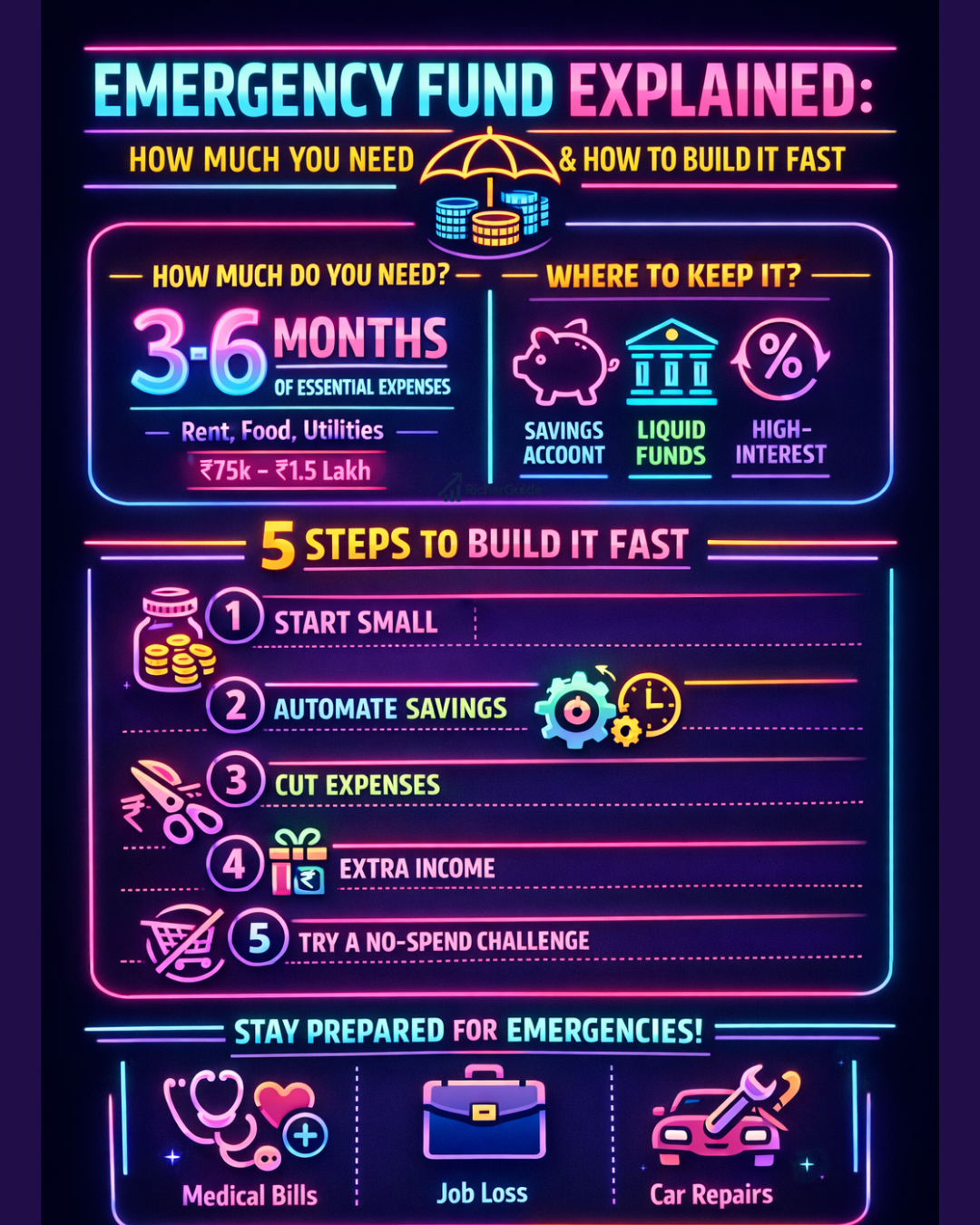

- Emergency fund

- Buying a home

- Early retirement

- Passive income targets

Clear goals make saving and investing meaningful.

When you know your “why,” it’s easier to stay disciplined.

10. Choosing Simplicity Over Complexity

In 2026, many wealthy people prefer simple money systems.

They avoid:

- Over-complicated investments

- Too many accounts

- Constant buying and selling

Instead, they:

- Stick to simple plans

- Review occasionally

- Let time do the work

Simplicity reduces mistakes and increases consistency.

Final Thoughts

The people getting richer in 2026 are not lucky.

They are not all high earners.

They simply follow smart, modern money habits:

- Automate savings

- Invest regularly

- Use technology wisely

- Keep learning

- Think long-term

You don’t need to change everything at once.

Start with one habit today, and build from there.

Small actions, repeated daily, create big wealth over time.

Understanding the importance of setting clear financial goals is crucial in these money habits.

Continuously learning about money habits can pave the way for success.

Incorporating these money habits can lead to a more fulfilling life.

By focusing on these money habits, anyone can achieve their financial dreams.