Many people believe that wealth is only for those with high salaries. But this is not true. You don’t need a big income to build wealth. What you really need are the right habits, smart planning, and patience.

Even small earners can create financial security and grow wealth over time. The secret is not how much you earn, but how well you manage what you earn. Let’s look at simple and practical ways to build wealth, even if your income is low.

Table of Contents

1. Change the Way You Think About Money

Wealth building starts in the mind. If you believe, “I earn too little to save,” you will never start. Instead, think this way:

“I can start small and grow slowly.”

Many wealthy people started with limited income. They focused on discipline, consistency, and long-term goals. When you see money as a tool not just something to spend—you begin to make better choices.

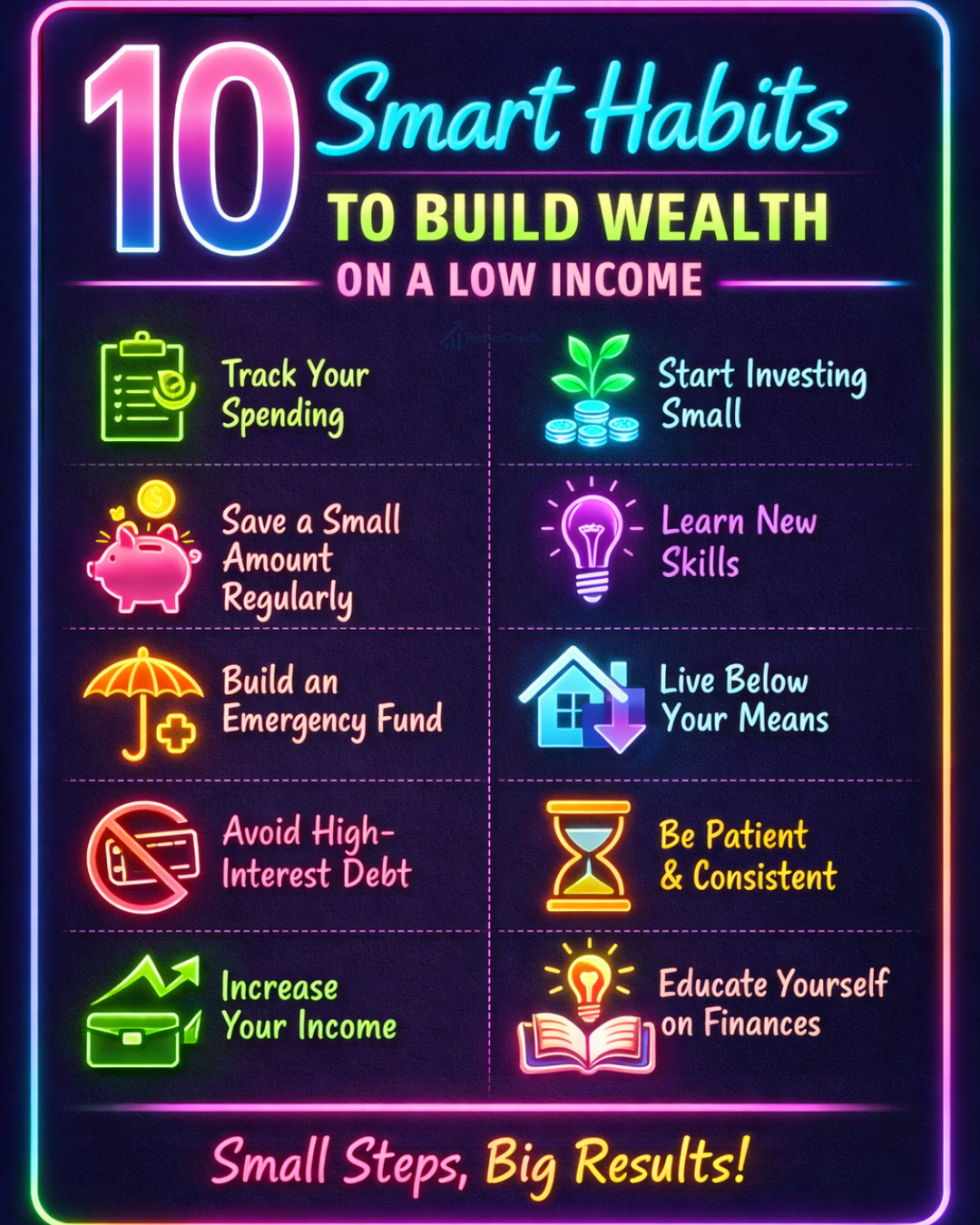

2. Track Every Rupee You Spend

If you don’t know where your money goes, you can’t control it. Tracking expenses is one of the most powerful habits for low-income earners.

Write down or use an app to track:

- Food expenses

- Rent and bills

- Transport

- Shopping and entertainment

After one month, you’ll notice spending leaks like online shopping, food delivery, or subscriptions you don’t really need. Cutting even small unnecessary expenses can free money for saving and investing.

3. Start Saving – Even If It’s Very Small

Many people wait to save until their income increases. That’s a mistake. Saving should start immediately, even if it’s just a small amount.

You can start with:

- ₹500 or ₹1,000 per month

- 5% or 10% of your income

The habit matters more than the amount. Once saving becomes automatic, you can increase it later when your income grows.

Tip: Set up auto-transfer to a savings account so you don’t forget.

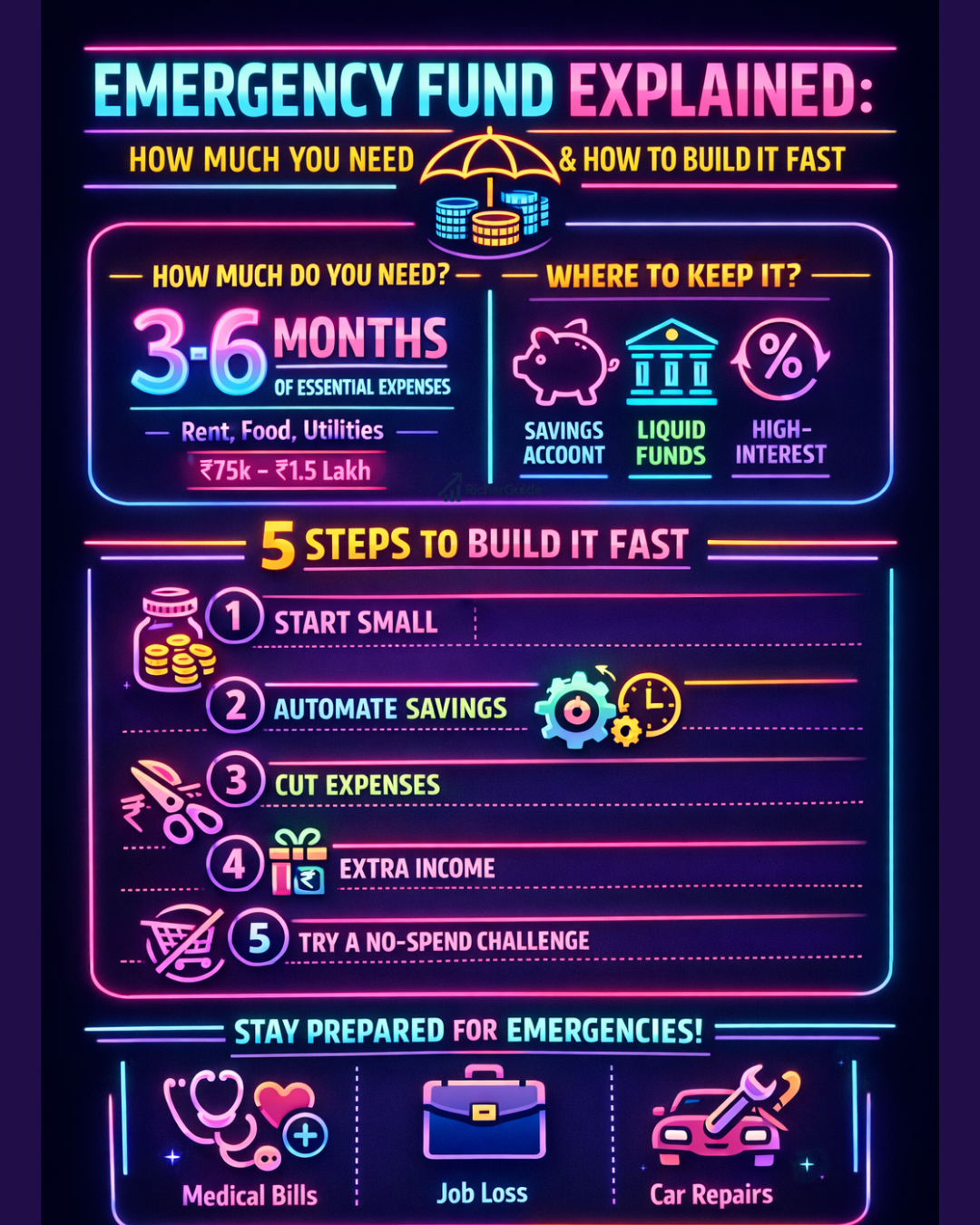

4. Build an Emergency Fund First

Before investing, you must protect yourself from financial shocks. An emergency fund helps you handle unexpected expenses like medical bills, job loss, or urgent repairs.

Aim for:

- 3 to 6 months of basic expenses

- Keep it in a savings account or liquid fund

This fund prevents you from using credit cards or loans during emergencies, which can destroy wealth.

5. Control Debt and Avoid Bad Loans

Debt is one of the biggest enemies of wealth, especially for low earners. High-interest debt like credit cards and personal loans can trap you for years.

Smart steps:

- Pay off high-interest debt first

- Avoid “buy now, pay later” habits

- Use credit cards only if you pay full bills on time

Good debt (like education or skill development) can increase income, but bad debt only increases stress.

6. Increase Your Income Slowly but Surely

If income is low, focus on increasing it over time. You don’t need to quit your job immediately. Start small.

Ideas to increase income:

- Freelancing or part-time work

- Online skills like content writing, design, or digital marketing

- Selling handmade products or services

- Learning a new skill that pays better

Even an extra ₹5,000–₹10,000 per month can make a big difference in saving and investing.

7. Start Investing With Small Amounts

You don’t need thousands to invest. Today, investing is possible with very small amounts.

Beginner-friendly options:

- SIP in mutual funds (start with ₹500)

- Index funds for long-term growth

- Recurring deposits if you want low risk

The key is to invest regularly and stay invested for the long term. Compounding works best when you give it time.

8. Be Patient and Stay Consistent

Wealth is not built in one year. It takes time. Many people quit because they don’t see fast results.

Remember:

- Small steps taken daily create big results

- Consistency beats perfection

- Market ups and downs are normal

Even modest investments can grow into a strong financial base if you stay disciplined.

9. Live Below Your Means

This is a simple but powerful rule. Try to spend less than you earn, even when income increases.

Avoid lifestyle inflation:

- Don’t upgrade everything when salary increases

- Focus on needs before wants

- Spend intentionally, not emotionally

Living below your means creates extra money that can be used to build wealth.

10. Educate Yourself About Money

You don’t need to be a finance expert, but basic knowledge helps you avoid mistakes.

Learn about:

- Saving and budgeting

- Simple investing concepts

- How interest and compounding work

Reading blogs, watching videos, or following trusted finance platforms can improve your money decisions.

Final Thoughts

Building wealth with a low income is not easy, but it is possible. You don’t need luck or a high salary. You need patience, discipline, and smart habits.

Start where you are. Save small. Invest wisely. Avoid debt. Increase income slowly. Over time, these simple steps can change your financial future.

Wealth is not about earning more it’s about managing better.