Learn which budgeting method suits you best; Zero-Based Budgeting or the 50-30-20 Rule. Understand how each works, see real examples, and find which helps you save more money faster.

Table of Contents

Why Budgeting Matters More Than Ever

In today’s world, managing money wisely is the difference between financial stress and financial freedom. Unfortunately, most of us were never taught how to budget effectively. A smart budgeting system helps you track spending, grow savings, and achieve your goals faster.

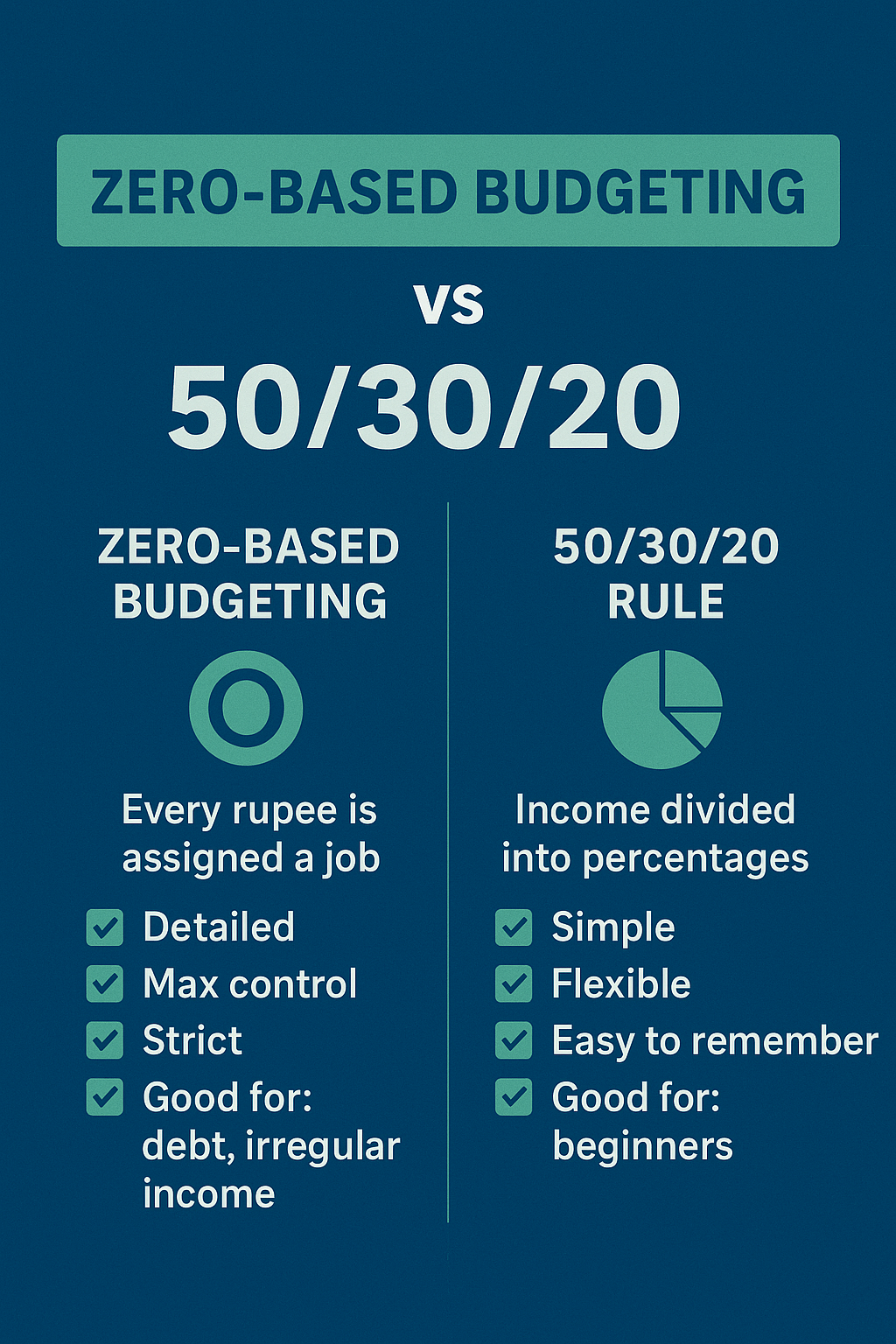

The two most popular methods people use today are Zero-Based Budgeting and the 50/30/20 Rule. Both can help you build financial discipline — but they work differently. Let’s break down how each works and find the one that fits your goals.

What is Zero-Based Budgeting (ZBB)?

Zero-Based Budgeting means you give every rupee a purpose. When you finish planning, your total income minus expenses, savings, and investments should equal zero.

Example:

If you earn ₹50,000/month, you decide exactly where every rupee goes — ₹15,000 for rent, ₹5,000 for transport, ₹10,000 for savings/investments, ₹3,000 for entertainment, and so on. Nothing is left unplanned.

How to Apply Zero-Based Budgeting

- Calculate your monthly income.

- List all fixed and variable expenses.

- Allocate amounts for savings, investments, and debt repayment.

- Adjust until every rupee is assigned — total = ₹0 unplanned.

This gives you total control over your money.

Learn more: Smart Money Management Tips

What is the 50/30/20 Rule?

The 50/30/20 Rule offers a simpler way to budget. It divides your after-tax income into three categories:

- 50% Needs: rent, groceries, utilities, transport

- 30% Wants: dining out, hobbies, travel, shopping

- 20% Savings/Investments: emergency fund, SIPs, retirement, debt repayment

Example:

If your take-home income is ₹60,000:

- ₹30,000 → Needs

- ₹18,000 → Wants

- ₹12,000 → Savings

This approach is great for beginners — easy to remember and flexible.

👉 Read next: How to Start Saving and Investing in India – Beginner’s Guide

Zero-Based Budgeting vs 50/30/20 Rule: Key Comparison

| Feature | Zero-Based Budgeting | 50/30/20 Rule |

|---|---|---|

| Setup | Detailed planning and tracking | Simple and quick |

| Control | Full control over every rupee | General structure |

| Flexibility | Less flexible | Very flexible |

| Time Required | Higher | Lower |

| Best For | Serious savers, debt repayers | Beginners or steady income earners |

Pros and Cons

Zero-Based Budgeting

Pros:

- Every rupee is tracked — perfect for goal-focused savers

- Reduces wasteful spending

- Helps you repay debt faster

Cons:

- Time-consuming

- Requires frequent updates

- Can feel rigid

50/30/20 Rule

Pros:

- Simple and beginner-friendly

- Offers spending flexibility

- Easy to maintain long-term

Cons:

- Not ideal for irregular income

- Can fail if “needs” exceed 50%

- Less precise than ZBB

Real-Life Example

Let’s compare how two people use each method:

Aarav earns ₹45,000/month and is paying off student loans.

He uses Zero-Based Budgeting, assigning every rupee — ₹12,000 rent, ₹6,000 groceries, ₹8,000 debt, ₹5,000 savings, ₹3,000 personal expenses.

This gives him structure and control.

Meera earns ₹80,000/month with stable expenses.

She follows the 50/30/20 Rule — ₹40,000 for needs, ₹24,000 for wants, ₹16,000 for savings.

She enjoys flexibility while still saving consistently.

Both succeed — they just follow systems that fit their personality and goals.

Which Budgeting Method Should You Choose?

✅ Choose Zero-Based Budgeting if:

- You want full control over spending

- You’re focused on debt repayment or big savings goals

- You’re comfortable tracking expenses regularly

✅ Choose the 50/30/20 Rule if:

- You’re new to budgeting

- You have a stable monthly income

- You want a stress-free, flexible plan

Some people even combine both — using the 50/30/20 framework for overall planning, but applying zero-based budgeting inside the 20% savings category to decide where each rupee is invested.

Frequently Asked Questions (FAQs)

1. What is the main difference between Zero-Based Budgeting and the 50/30/20 Rule?

Zero-Based Budgeting assigns every rupee a purpose , your income minus expenses equals zero. The 50/30/20 Rule divides your income into simple percentages: 50% needs, 30% wants, and 20% savings. The first is more detailed and hands-on, while the second is easier for beginners.

2. Which budgeting method is best for beginners?

If you’re just starting out, the 50/30/20 Rule is easier to follow. It doesn’t require daily tracking and gives you a clear structure to manage your salary. Once you’re comfortable, you can switch to Zero-Based Budgeting for deeper control.

3. Can I use both Zero-Based Budgeting and the 50/30/20 Rule together?

Yes. Many people use the 50/30/20 Rule for broad planning and then apply Zero-Based Budgeting inside the savings category to plan exactly how that 20% will be used, for example, SIPs, emergency funds, or debt repayment.

4. Which budgeting method works best for irregular income?

Zero-Based Budgeting works better for freelancers or people with variable income. It helps you plan your spending each month based on actual income and ensures every rupee is allocated properly, even when income fluctuates.

5. Is the 50/30/20 Rule realistic for high-cost cities in India?

Not always. In metro cities where rent and living expenses are high, needs may take up more than 50% of income. You can tweak the ratio to 60/25/15 or 70/20/10 to fit your lifestyle — the key is consistency, not perfection.

6. What tools or apps can help me manage my budget?

You can start with simple tools like Google Sheets, Money Manager, or Walnut App. For full control, you can download the free budget tracker or use personal finance apps that support Zero-Based Budgeting.

7. How can I stick to a budget without feeling restricted?

Start with realistic spending goals, review your expenses weekly, and allow some room for small “wants.” Budgeting isn’t about cutting everything — it’s about spending smarter. Check out our guide on Money Management Tips to learn how to stay consistent.

8. How often should I review my budget?

Ideally, review your budget once a month. If your income varies, do a quick review every two weeks. Update your spending categories and track progress toward your savings and investment goals.

9. What’s the best way to build savings with a small income?

Start small — even ₹500 a month adds up. Use the Zero-Based Budgeting method to ensure you assign part of every paycheck to savings or investing. You can explore more tips in our Beginner’s Savings Guide.

10. What is the goal of budgeting?

The goal isn’t restriction — it’s financial freedom. Budgeting helps you understand where your money goes, reduce stress, and make smarter choices for your future.

Final Thoughts

There’s no one-size-fits-all approach to budgeting. The best budget is the one you’ll actually stick to.

Whether you go for the Zero-Based Budgeting method or the 50/30/20 Rule, consistency matters more than perfection. Try each method for a few months and see which feels more natural.

👉 Explore more budgeting and investing guides on RicherGuide.com. your go-to source for personal finance, investment planning, and smart money habits.

External References: