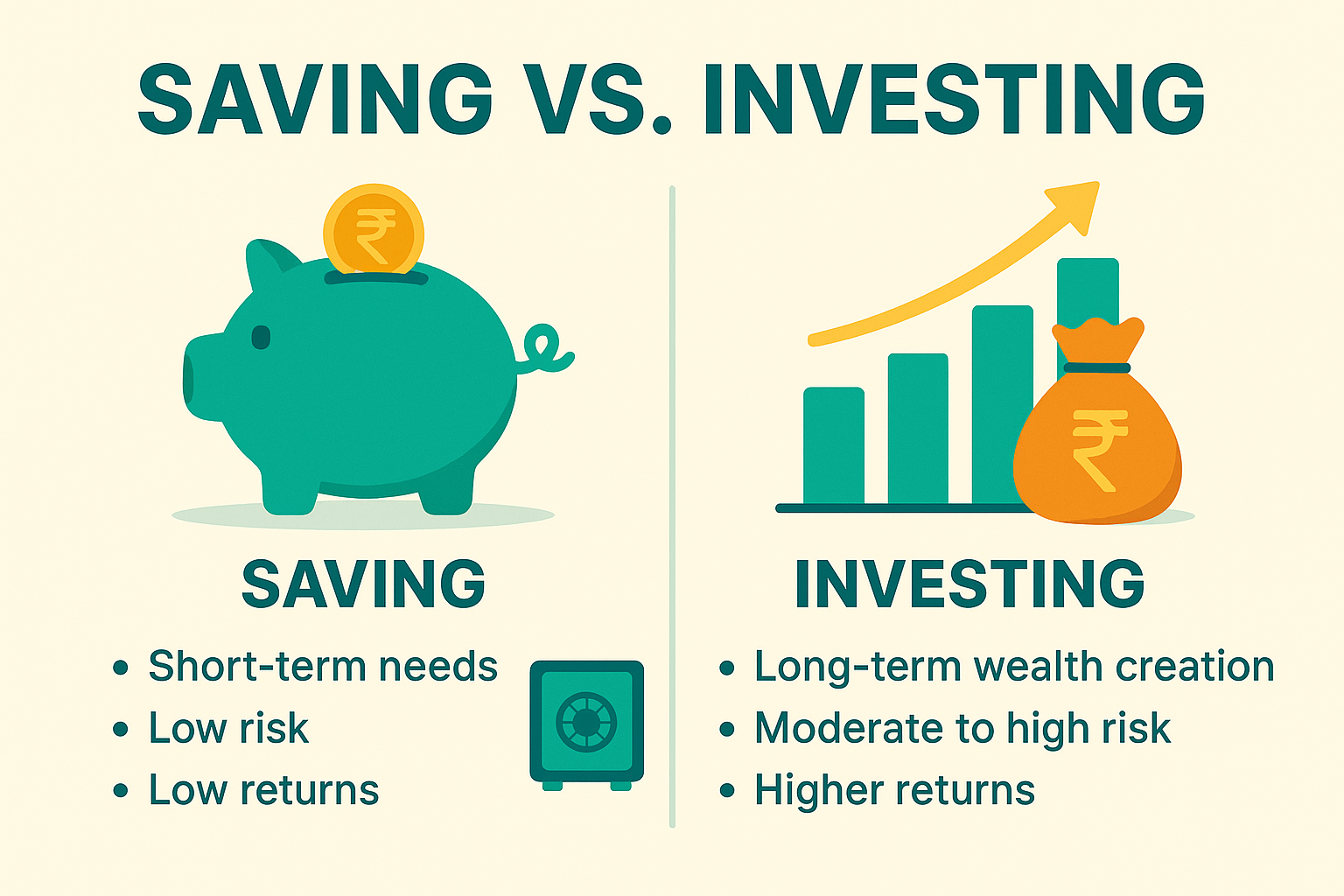

When it comes to money, most people often use the words saving and investing as if they mean the same thing. But in reality, they are very different. Both saving and investing are important for financial health, just like food and exercise are important for good health. Knowing the difference can help you make smarter money decisions and achieve your financial goals faster.

Table of Contents

What is Saving?

Saving simply means putting money aside in a safe place for short-term needs. It is usually low-risk, easily accessible, and earns small but steady returns.

the most Usual saving options are:

- Savings Bank Account – Safe, liquid, but low interest (around 3–4% annually).

- Fixed Deposits (FDs) – Guaranteed returns, usually between 5–7%.

- Recurring Deposits (RDs) – Small monthly savings for a fixed period.

Example:

Ramesh, a young IT professional, saves ₹5,000 every month in a recurring deposit. His goal is to buy a scooter in 12 months. Since his goal is short-term, he doesn’t want to risk his money in the stock market. Saving works best for him here.

What is Investing?

Investing means putting money into assets that can grow over time, but with some risk. The main aim is wealth creation. Investments may not always give guaranteed returns, and sometimes there may be losses, especially in the short run. But over the long term, investing usually beats inflation and builds wealth.

In usual investment options include:

- Mutual Funds (Equity/Hybrid/Debt)

- Stock Market (Shares of companies like Infosys, TCS, HDFC Bank, etc.)

- Gold (Digital gold, Gold ETFs, Sovereign Gold Bonds)

- Real Estate

Example:

Neha, a 30-year-old teacher, invests ₹10,000 per month in an equity mutual fund SIP. Her goal is to build a corpus for her daughter’s higher education in 15 years. Though the market may go up and down, the power of compounding and long-term growth will help her reach her goal.

Key Differences Between Saving and Investing

| Feature | Saving | Investing |

|---|---|---|

| Purpose | Short-term needs, emergencies and safety | Long-term wealth creation, financial goals |

| Risk | Very low | Moderate to high |

| Returns | Low (3–7%) | Higher (8–15% or more over long term) |

| Liquidity | Highly liquid (can be withdrawn anytime) | May not be easily liquid (stocks, mutual funds, real estate) |

| Examples | Savings account, FD, RD | Mutual funds, stocks, gold, real estate |

Why Both Are Important?

Many people ask, “Should I save or invest?” The truth is you need both.

- Saving acts as your safety net. For example, having 6 months of expenses in a savings account or FD helps during emergencies like job loss or medical bills.

- Investing helps you grow wealth and beat inflation. For example, if you want to retire comfortably, only saving won’t help because inflation will reduce the value of your money.

Realistic Example: Balancing Saving and Investing

Let’s take the case of a married couple, Amit and Priya.

- They keep ₹1.5 lakh in a bank FD for emergencies.

- They invest ₹20,000 monthly in mutual funds (SIPs) for long-term goals like buying a house and retirement.

- They also buy Sovereign Gold Bonds once a year for portfolio diversification.

Here, their savings give them safety, while investments give them growth. This balanced approach keeps their present and future secure.

Common Mistakes

- Keeping too much money in savings accounts – The returns don’t beat inflation.

- Investing without an emergency fund – Selling investments in a hurry during a crisis can cause losses.

- Confusing insurance with investment – Many people buy insurance policies thinking they are “investment plans,” which usually give poor returns.

- Not starting early – Delaying investments means losing the power of compounding.

How to Decide Between Saving and Investing?

- For short-term goals (1–3 years): Save (FD, RD, savings account).

- For long-term goals (5+ years): Invest (mutual funds, stocks, gold, real estate).

- Emergency fund: Always save at least 3–6 months of expenses before starting to invest.

Conclusion

Savings and investments are like two sides of the same coin. Savings give you stability and peace of mind, while investments give you growth and financial freedom. The key is to strike a balance depending on your goals.

a smart mix of both, like keeping money in FDs for emergencies and investing in mutual funds or gold for the future can ensure a strong financial foundation.