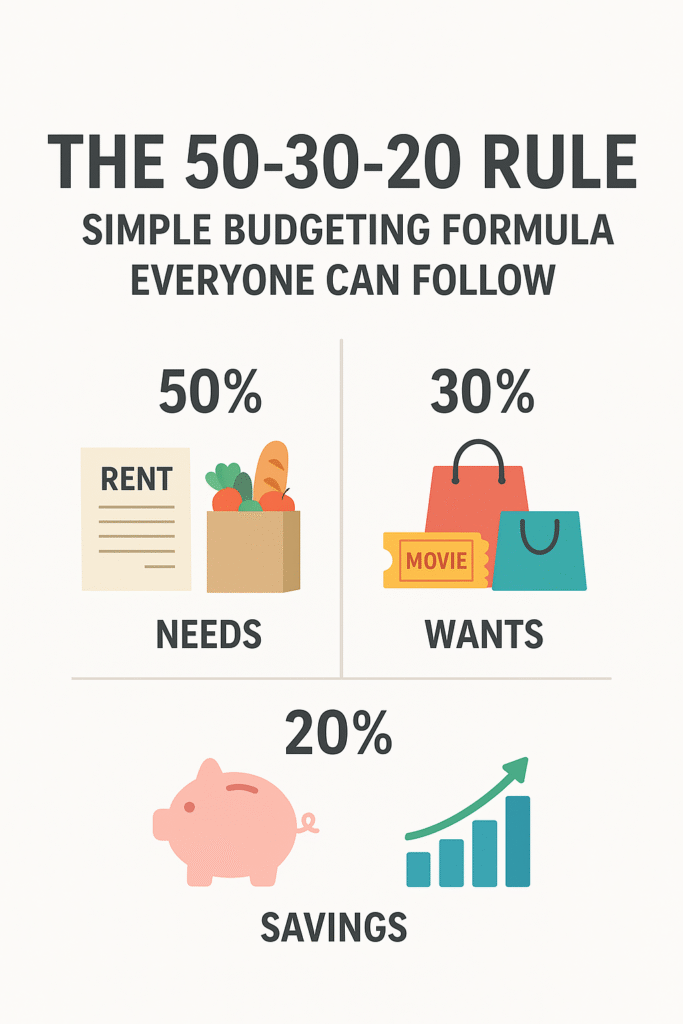

Managing money doesn’t have to feel complicated. One of the most effective and simple methods is the 50-30-20 rule of personal finance. Whether you are a student, a working professional, or running a family budget, this method can help you understand where your money goes and how to save without stress.

In this blog, we’ll break down what the 50-30-20 rule is, how it works, and how you can apply it in real life with examples, templates, and tools.

Table of Contents

What is the 50-30-20 Rule?

The 50-30-20 rule is a budgeting method that divides your income into three categories:

- 50% for Needs – Essential expenses like rent, food, utilities, transportation, and healthcare.

- 30% for Wants – Lifestyle choices such as dining out, shopping, entertainment, travel, or subscriptions.

- 20% for Savings & Debt Repayment – Savings, investments, emergency fund, and paying off loans or credit cards.

This rule makes budgeting easier because it sets clear percentages you can stick to.

Step-by-Step Guide to Using the 50-30-20 Rule

Step 1: Calculate Your Monthly Income

First, know how much you actually earn each month (after taxes).

Example:

- Salary: ₹50,000 per month

Step 2: Divide Your Income into Categories

Using the 50-30-20 rule:

- Needs (50%) → ₹25,000

- Wants (30%) → ₹15,000

- Savings & Debt (20%) → ₹10,000

Step 3: Track Your Spending

Note down your expenses for each category. You can use apps like Mint, YNAB, or even a simple Excel sheet.

Step 4: Adjust If Needed

If your “needs” are taking up 70% of your income, try to cut down on non-essential spending until you balance closer to 50-30-20.

Example in Table Format

| Category | Percentage | Monthly Income (₹50,000) | Example Expenses |

|---|---|---|---|

| Needs | 50% | ₹25,000 | Rent, groceries, bills, fuel |

| Wants | 30% | ₹15,000 | Shopping, Netflix, eating out |

| Savings & Debt | 20% | ₹10,000 | SIPs, FD, emergency fund, loan EMI |

Here’s a simple template to start today:

Monthly Budget Planner (50-30-20 Rule)

- Total Income: _______

- 50% Needs: _______

- 30% Wants: _______

- 20% Savings/Debt: _______

You can create this in Excel, Google Sheets, or even in a notebook.

Why the 50-30-20 Rule Works

✔ Keeps your spending balanced

✔ Ensures you save regularly

✔ Easy to follow without complicated formulas

✔ Works for almost every income level

Final Thoughts

The 50-30-20 rule of personal finance is not about restricting yourself but about creating balance. By dividing your income into needs, wants, and savings, you’ll always know where your money is going and how to stay financially secure.

Start with small steps, track your expenses for a month, and you’ll see how this simple method can transform your financial life in 2025.