Learn how to create a monthly budget with this simple step-by-step budget planning guide. Track income, manage expenses, and save more every month.

Managing money can feel overwhelming. However, a monthly budget is the easiest way to take control of your finances. A budget not only shows where your money goes, but it also helps you save and prevents overspending. Whether you’re a student, a working professional, or managing a family, this step-by-step budget planning guide will help you create a budget that actually works.

Table of Contents

Why Do You Need a Monthly Budget?

Before we jump into the steps, let’s first understand why budgeting is so important:

- You’ll know exactly how much you earn and spend.

- It prevents overspending and debt.

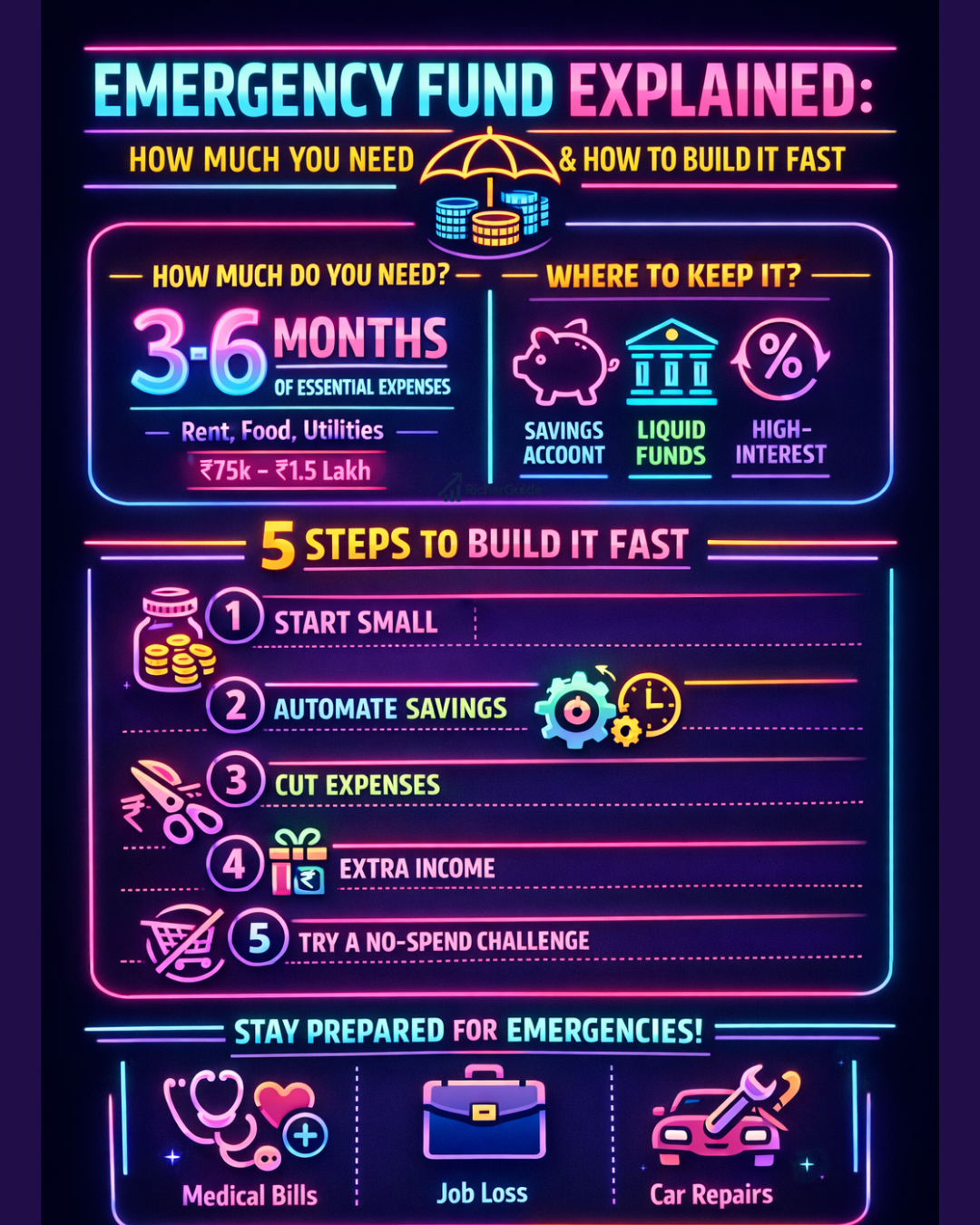

- You can start saving for emergencies, goals, or investments.

- It reduces financial stress.

In other words, think of a budget like a roadmap. Without it, you might get lost financially. With it, however, you reach your goals faster.et lost financially. With it, you reach your goals faster.

Step 1: Calculate Your Monthly Income

To begin with, write down all sources of income you receive in a month. This could include:

- Salary (after tax)

- Freelance or side hustle income

- Rental income

- Any other regular source

👉 Example:

- Salary: ₹45,000

- Freelance work: ₹5,000

- Total income: ₹50,000

By knowing your exact income, you create a strong base for your budget planning.

Step 2: Track Your Monthly Expenses

Next, list all your expenses and divide them into two categories:

- Fixed expenses – rent, electricity bill, phone bill, school fees

- Variable expenses – groceries, shopping, dining out, entertainment

👉 Example Monthly Expenses:

| Expense Category | Amount (₹) |

|---|---|

| Rent | 12,000 |

| Groceries | 8,000 |

| Electricity & Bills | 3,000 |

| Transport | 2,500 |

| Dining Out | 2,000 |

| Shopping | 3,500 |

| Savings/Investments | 5,000 |

| Miscellaneous | 2,000 |

| Total | 38,000 |

As a result, you’ll clearly see how much money is going out each month.

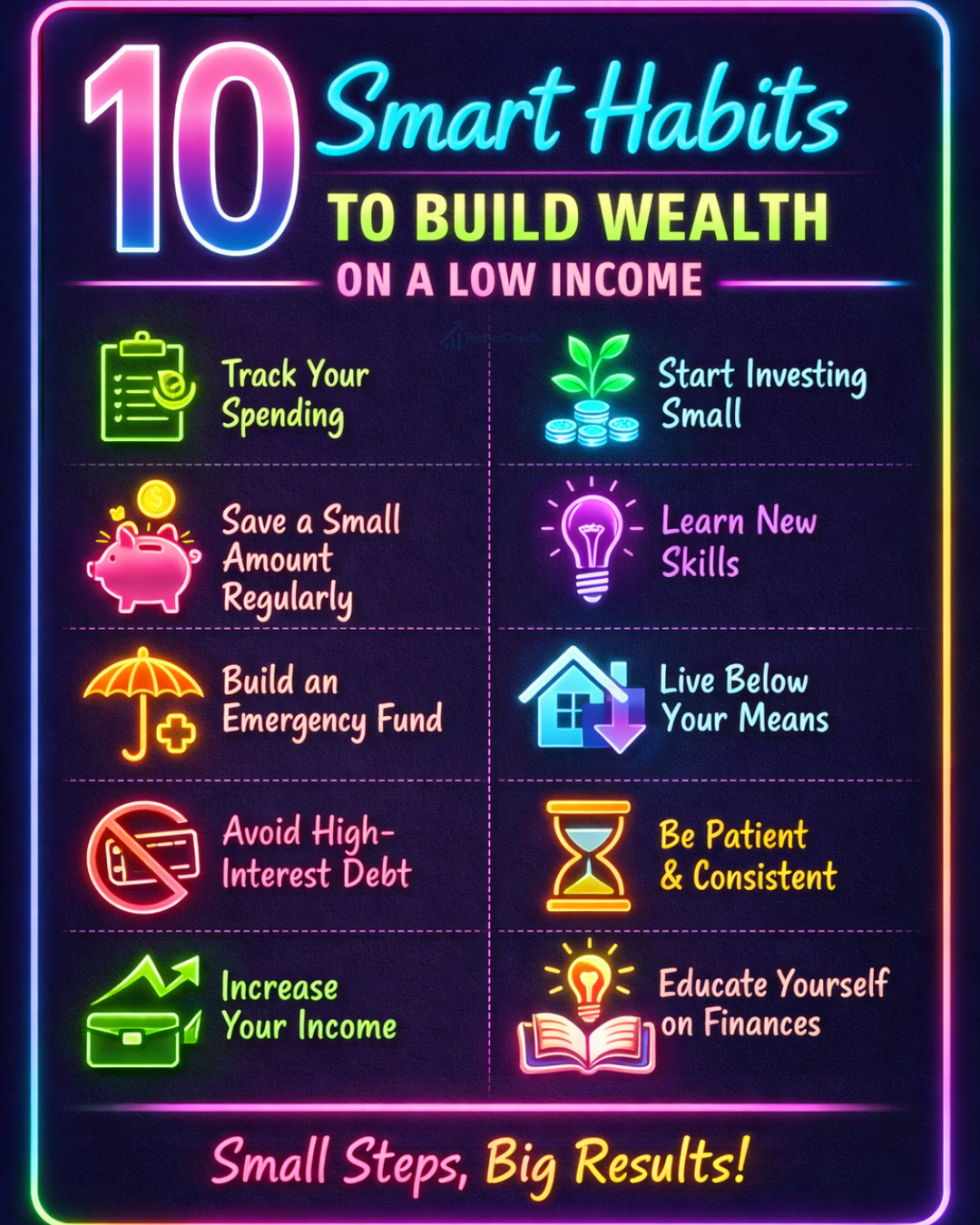

Step 3: Set Your Savings Goal

A smart monthly budget always includes savings. One of the best strategies is the 50-30-20 rule:

- 50% of income for needs (rent, food, bills)

- 30% for wants (shopping, movies, travel)

- 20% for savings (emergency fund, investments)

👉 Example with ₹50,000 income:

- Needs: ₹25,000

- Wants: ₹15,000

- Savings: ₹10,000

This way, you save every month without sacrificing your lifestyle.

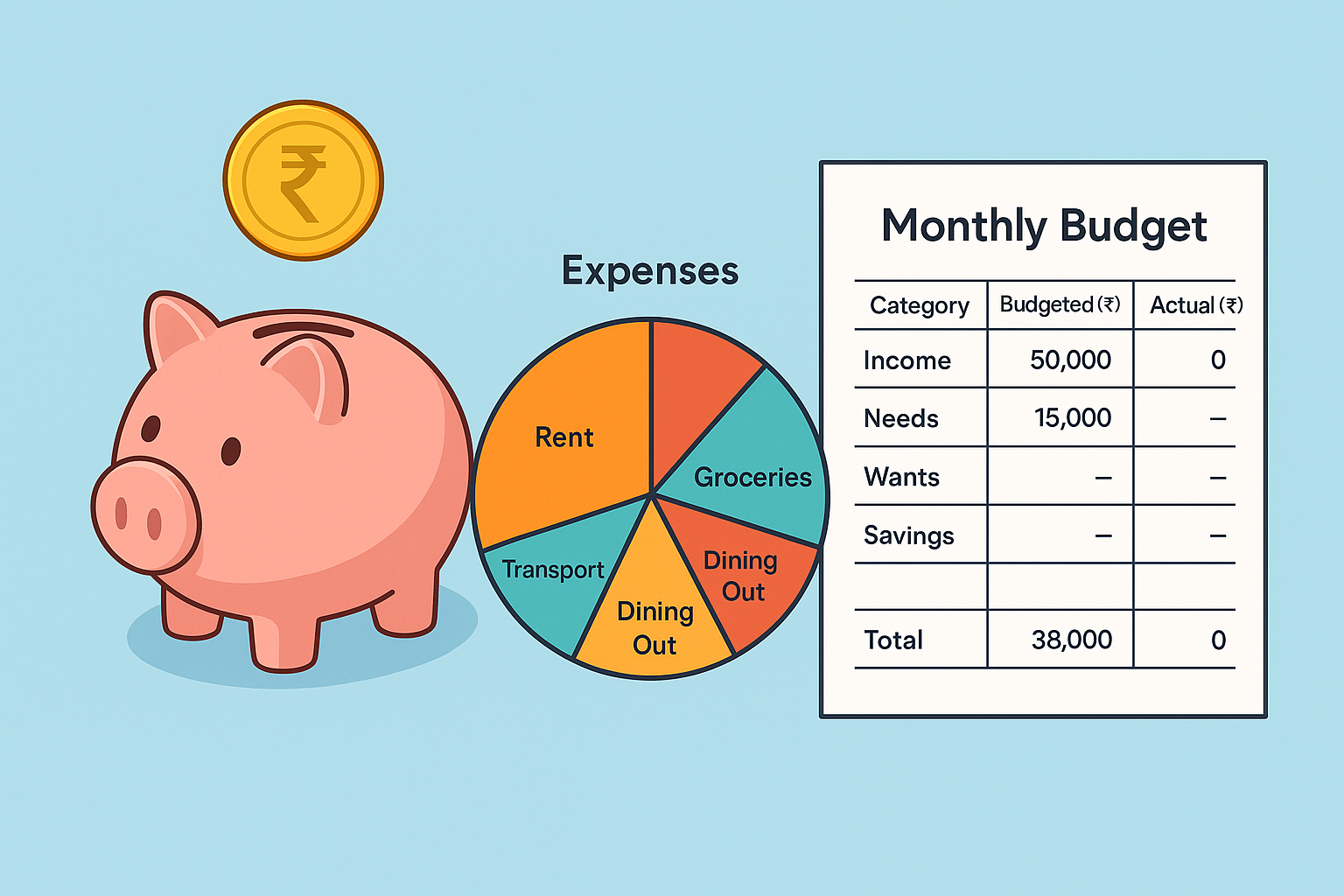

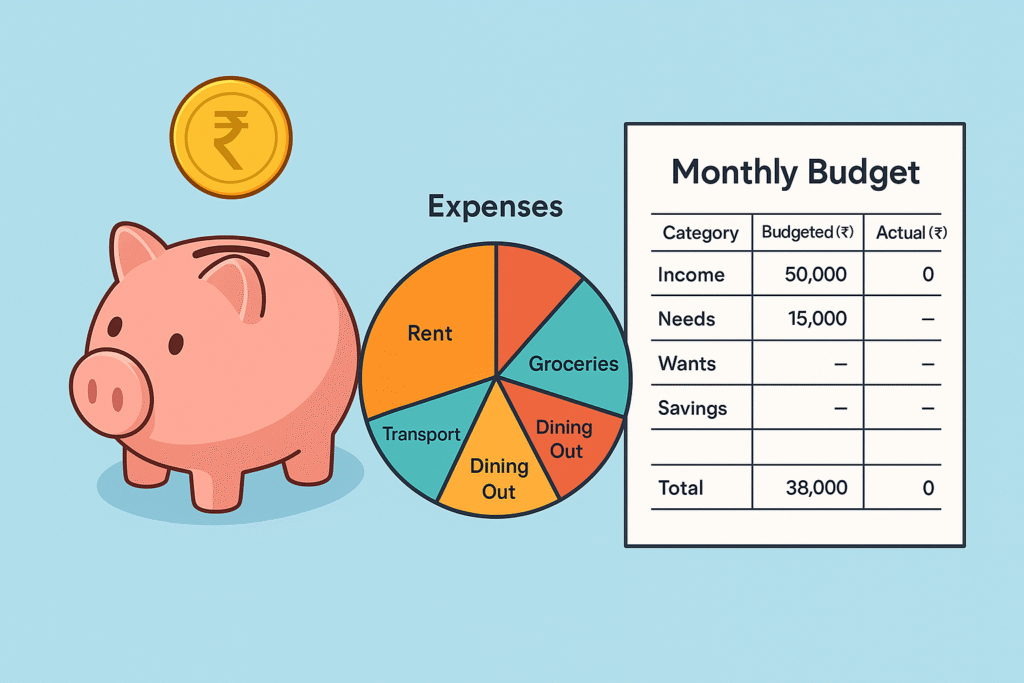

Step 4: Create Your Monthly Budget Template

After that, build a simple template you can reuse every month.

| Category | Budgeted (₹) | Actual (₹) | Difference |

|---|---|---|---|

| Income | 50,000 | 50,000 | 0 |

| Needs | 25,000 | 24,000 | 1,000 |

| Wants | 15,000 | 14,000 | 1,000 |

| Savings | 10,000 | 10,000 | 0 |

As the month goes on, update the “Actual” column to keep track of your spending.

Step 5: Adjust and Review

Finally, at the end of the month, compare your planned budget with actual expenses. Did you overspend on dining out? Did you save more than expected? If yes, make small adjustments to improve your budget for the next month.

Extra Tips to Stick to Your Budget

- Use free apps like Walnut, Money Manager, or a simple Excel sheet.

- Always pay yourself first (put money in savings the day you get paid).

- Avoid using credit cards for wants.

- Instead of waiting until month-end, review your expenses weekly.

Final Thoughts

A budget isn’t about restricting yourself. Rather, it’s about making your money work for you. By following this monthly budget guide, you’ll gain more clarity, build savings, and reduce financial stress.

To sum up, start with one month, track your progress, and you’ll soon see how powerful a simple monthly budget can be.