If you’re a freelancer, creator, or gig worker, you already know one big challenge of working for yourself: your income isn’t always the same every month. Some months you might earn a lot, and in others, you may barely make enough to cover your basic expenses. This uncertainty often makes budgeting feel impossible.

But here’s the good news: with the right money plan, you can still create stability and security, even when your income changes from month to month. In this blog, we’ll explore practical, easy-to-follow budgeting tips for anyone earning an irregular income.

Table of Contents

Why Budgeting is Hard with Irregular Income

When you’re not on a fixed salary, it’s tricky to decide how much to spend and save. Some common struggles include:

- Unpredictability: You don’t know exactly how much money will come in each month.

- Overconfidence: A high-earning month makes you feel rich, and you end up overspending.

- Stress in slow months: When income drops, bills and expenses still need to be paid.

- Difficulty saving: With no steady paycheck, savings often take a back seat.

These challenges are real, but they can be managed with a smart approach.

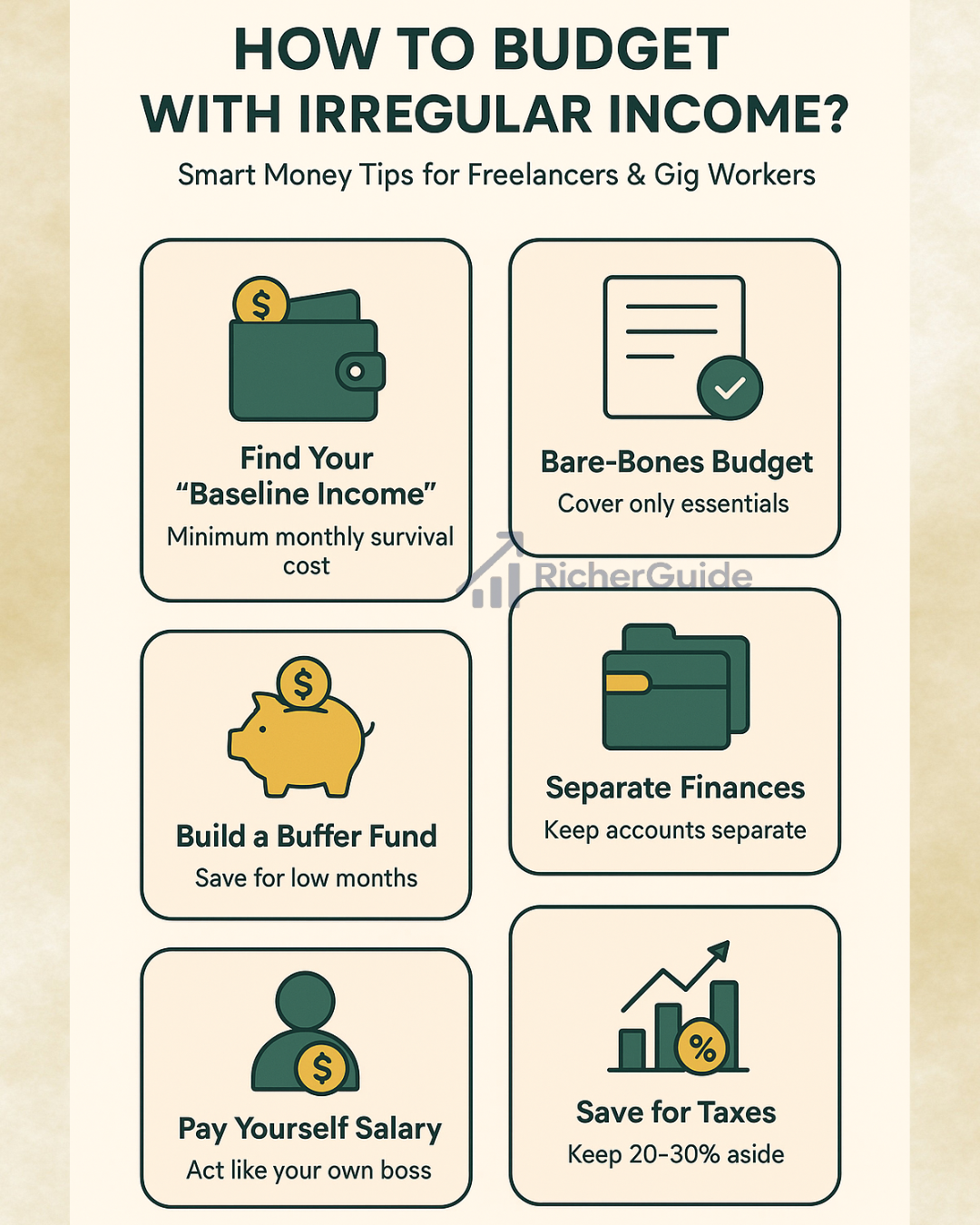

Step 1: Find Your “Baseline Income”

The first step is to figure out the minimum income you need each month to survive. This is called your baseline income.

To calculate it, list all your essential expenses:

- Rent or mortgage 🏠

- Groceries 🍎

- Utilities (electricity, water, internet) 💡

- Transportation 🚗

- Minimum loan or EMI payments 💳

- Basic insurance 💊

Add them up. That number is your monthly survival cost.

For example, if your essential expenses add up to ₹40,000, then your baseline income is ₹40,000.

This number is important because it tells you the minimum you must earn (or keep aside) each month to feel financially safe.

Step 2: Use Your “Lowest Average Income” as a Guide

Instead of budgeting around your best months, use your worst months as a reference.

Look back at the past 6–12 months of income. What’s the lowest monthly amount you earned? Use that number as your budgeting base.

Why? Because if you can build a budget around the worst-case scenario, you’ll always be prepared. And in high-income months, you’ll have extra money to save or invest.

Step 3: Create a “Bare-Bones Budget”

When income is irregular, it helps to have two types of budgets:

- Bare-Bones Budget → Covers only essential expenses (like the baseline we calculated earlier).

- Full Budget → Includes extra spending on wants like dining out, subscriptions, shopping, or travel.

This way, when income is low, you follow the bare-bones version. When income is high, you can switch to your full budget and enjoy some flexibility.

Step 4: Separate Business & Personal Finances

If you’re a freelancer or creator, your money often comes from different sources—clients, ad revenue, brand deals, or gigs. Mixing all this with personal spending can get messy.

Here’s what you should do:

- Open a separate business account for receiving income.

- Pay yourself a fixed monthly salary from that account.

- Keep business expenses (software, equipment, ads, etc.) separate from personal ones.

This makes it easier to track how much you actually earn and spend.

Step 5: Build a “Buffer Fund”

A buffer fund is like a safety net for months when income is low.

How to build it:

- In high-income months, save a big chunk instead of spending it all.

- Slowly grow this fund until you have at least 3–6 months of baseline expenses saved.

- When income drops, dip into this fund instead of stressing about money.

Think of it as smoothing the highs and lows of irregular income.

Step 6: Follow the 50/30/20 Rule (with Flexibility)

The popular 50/30/20 rule can be adapted for freelancers:

- 50% Needs → Rent, food, bills, insurance.

- 30% Wants → Lifestyle expenses, entertainment, shopping.

- 20% Savings & Investments → Emergency fund, retirement, goals.

When income is high → stick to 50/30/20.

When income is low → focus on 50% needs and reduce wants to 10% or less, while still trying to save something.

The goal is to keep your savings habit alive, no matter how small.

Step 7: Pay Yourself a “Steady Salary”

Here’s a trick many freelancers use: act like you’re your own employer.

- Each month, decide on a fixed salary you’ll “pay yourself” from your income (for example, ₹40,000).

- If you earn more than that, the extra money goes into savings or your buffer fund.

- If you earn less, use money from the buffer to cover your “salary.”

This makes your income feel stable—even if it isn’t.

Step 8: Track Every Rupee

When money comes in irregularly, tracking becomes more important than ever.

- Use apps like Walnut, Money Manager, or Mint to track spending.

- Review your income and expenses every month.

- Look for leaks (like unused subscriptions or impulse shopping).

The more aware you are of your money, the more control you’ll have.

Step 9: Save for Taxes

As a freelancer or gig worker, you don’t get automatic tax deductions like salaried employees. That means you must set aside money for taxes yourself.

A good rule is to save 20–30% of each payment you receive into a separate tax account. This way, when tax season comes, you won’t panic.

Step 10: Plan Ahead for Irregular Expenses

Apart from irregular income, freelancers also face irregular expenses like buying a new laptop, upgrading software, or medical bills.

The solution:

- Create sinking funds (small savings buckets) for big upcoming costs.

- Save a little each month for these, so you don’t drain your emergency fund later.

Key Takeaways

Budgeting with irregular income may feel overwhelming, but with the right strategy, it’s totally manageable.

- Know your baseline income (monthly survival cost).

- Budget based on your lowest income months, not the highest.

- Keep a bare-bones budget ready for tough times.

- Build a buffer fund to smooth income ups and downs.

- Pay yourself a steady salary from your irregular earnings.

- Save for taxes and future expenses.

Remember: freelancing, creating, or gig work gives you freedom and flexibility, but it also comes with responsibility. The more you plan, the less financial stress you’ll face.

With discipline, you can enjoy the ups, survive the downs, and build long-term financial stability—even without a fixed paycheck.