Creating a budget is one of the most powerful steps you can take toward better money management and personal finance success. Yet, many people make budget mistakes that prevent them from saving money and reaching their goals. In this guide, discover the most common budgeting mistakes and learn simple ways to avoid them for stress-free financial planning.

Table of Contents

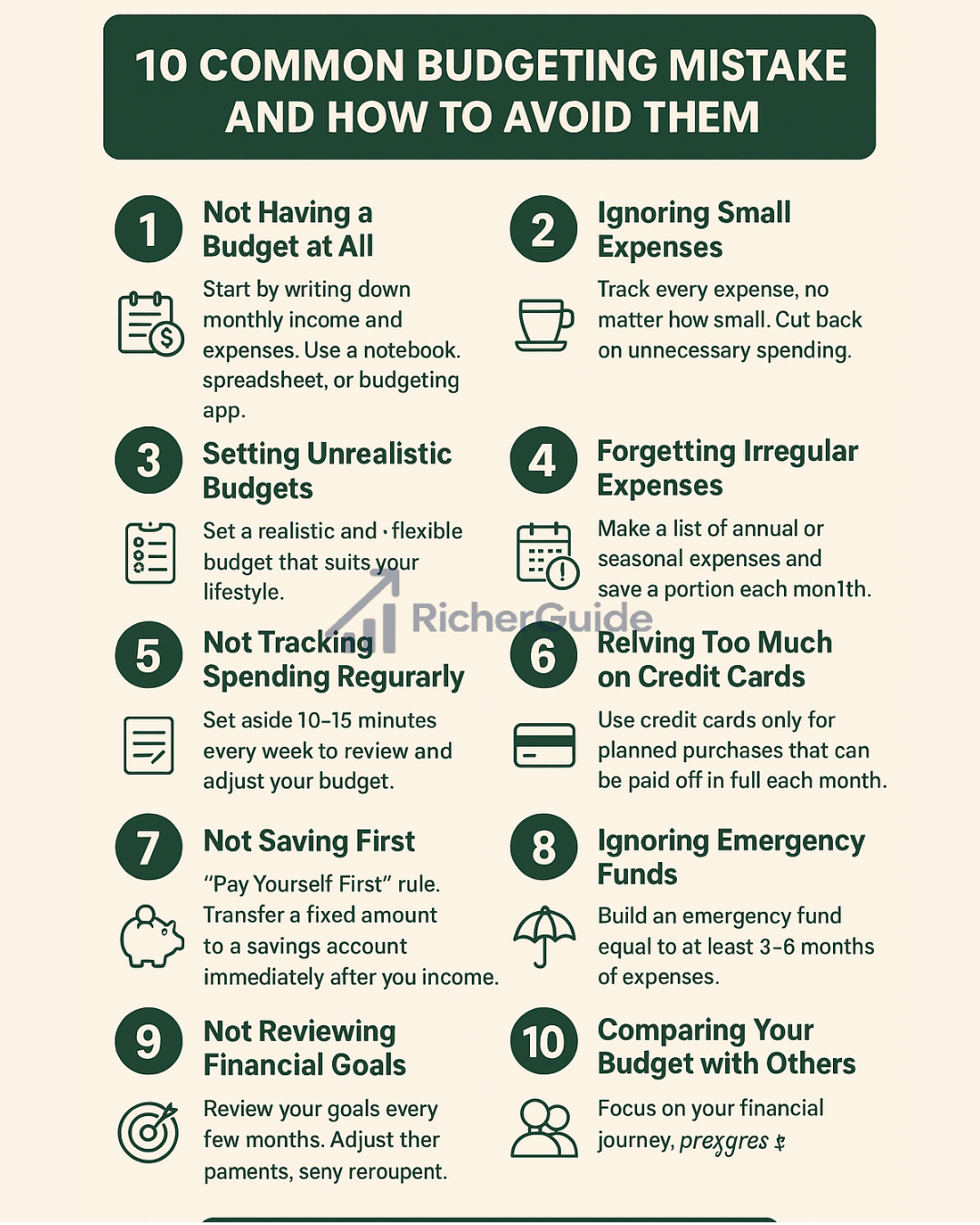

1. Not Having a Budget

Mistake: Skipping a budget altogether — this is the #1 reason for missed financial goals. Without a budget planner, small and large expenses quickly spiral out of control.

How to fix it: Start with a simple monthly budget planner or an expense tracker (spreadsheet or budgeting app). Record all sources of income and your monthly expenses for a full money overview.

2. Ignoring Small Expenses

Mistake: Overlooking daily coffee runs or app subscriptions can drain your savings over time.

How to fix it: Track every expense, even the small ones, using an expense tracker or budgeting tools. Redirect unnecessary spending into your savings account.

3. Setting Unrealistic Budgets

Mistake: Restrictive budgets that eliminate all “fun” categories discourage consistency.

How to fix it: Set a flexible, realistic budget based on your actual lifestyle and spending tracker history. Include room for entertainment and hobbies.

4. Forgetting Irregular Expenses

Mistake: Only planning for regular bills ignores annual expenses like insurance or car repairs.

How to fix it: List all seasonal or once-a-year costs. Divide by 12 to save a little each month in your budget tracker–that way, you’re always prepared.

5. Not Tracking Spendings

Mistake: Budgeting once, then never following up, leads to overspending and ineffective money management.

How to fix it: Dedicate 10–15 minutes weekly to check your budget spreadsheet or app. Consistent tracking prevents end-of-month surprises.

6. Relying on Credit Cards

Mistake: Using credit cards for unplanned purchases causes debt.

How to fix it: Use credit cards only for planned purchases you can pay off in full each month. Otherwise, switch to debit or cash for daily spending.

7. Not Saving First

Mistake: Saving only what is left at the month’s end–which is often nothing.

How to fix it: Apply the “pay yourself first” rule. Automatically transfer a fixed amount to your savings account as soon as you get paid.

8. Ignoring Emergency Funds

Mistake: Neglecting an emergency fund leaves you vulnerable to surprise expenses or job loss.

How to fix it: Build an emergency fund with 3–6 months’ living expenses. Start with small, regular deposits in a separate high-interest savings account.

9. Not Reviewing Goals

Mistake: Failing to update your budget as your life and goals change (job, family, priorities).

How to fix it: Review and adjust your financial goals (monthly or quarterly) to keep your budget aligned and on track.

10. Comparing With Others

Mistake: Measuring your progress or budget against others can lead to discouragement or poor financial decisions.

How to fix it: Your budget should be tailored to your needs, not someone else’s lifestyle. Focus on your own progress.

Bonus: Use the 50/30/20 Rule

If you’re unsure where to start, follow the proven 50/30/20 rule:

- 50% of income for needs (rent, groceries, utilities)

- 30% for wants (entertainment, shopping)

- 20% for savings or debt repayment

This approach balances your financial priorities while keeping budgeting simple.

FAQ: People Also Ask

What is the most common budgeting mistake?

Most people fail because they never create a budget at all or never track their spending.

How do you create a realistic budget?

Start by tracking your real expenses for a month. Use a simple budget planner or spreadsheet, then allocate for needs, wants, savings, and periodic expenses.

What percentage should go to savings?

Financial planners recommend at least 20%, following the 50/30/20 budgeting rule.

How often should you review your budget?

Check your spending weekly and review goals monthly or quarterly for best results.

Quick Takeaways

- Always use a written or digital budget planner.

- Record all expenses — big and small — with an expense tracker.

- Set flexible, realistic goals based on real data.

- Pay yourself first by saving automatically.

- Review & update your budget regularly for financial confidence.

Start taking charge of your money today with smart, simple budgeting habits. Avoid these budget mistakes and step confidently toward your financial freedom and success.