Money influences almost every part of our lives our daily needs, future plans, and mental wellbeing. Yet many struggle to manage it effectively. That’s where budgeting comes in. A budget is much more than just a spending cut plan; it’s the blueprint for your financial success. Think of it like the foundation of a house: without it, everything else is unstable. This guide will cover everything you need to know about budgeting, why it’s essential, and practical steps to create your own budget that fits your lifestyle.

Table of Contents

What is Budgeting?

Budgeting is the process of planning how to allocate your money—understanding your incomes and expenses clearly. It’s like having a roadmap for your cash flow. Instead of guessing where your money goes each month, budgeting lets you see exactly where it’s spent so that you can steer your finances toward your goals.

Why is Budgeting Important?

Budgeting is often misunderstood as restrictive, but it actually empowers you by giving control over money. Here’s why budgeting is critical:

- Gain control over your finances: Know where every dollar goes.

- Avoid unwanted debt: Prevent overspending by living within your means.

- Save for your goals: Whether it’s a home, vacation, or retirement.

- Reduce financial anxiety: Clear plans help ease money stress.

- Prepare for emergencies: Build an emergency fund for unexpected expenses.

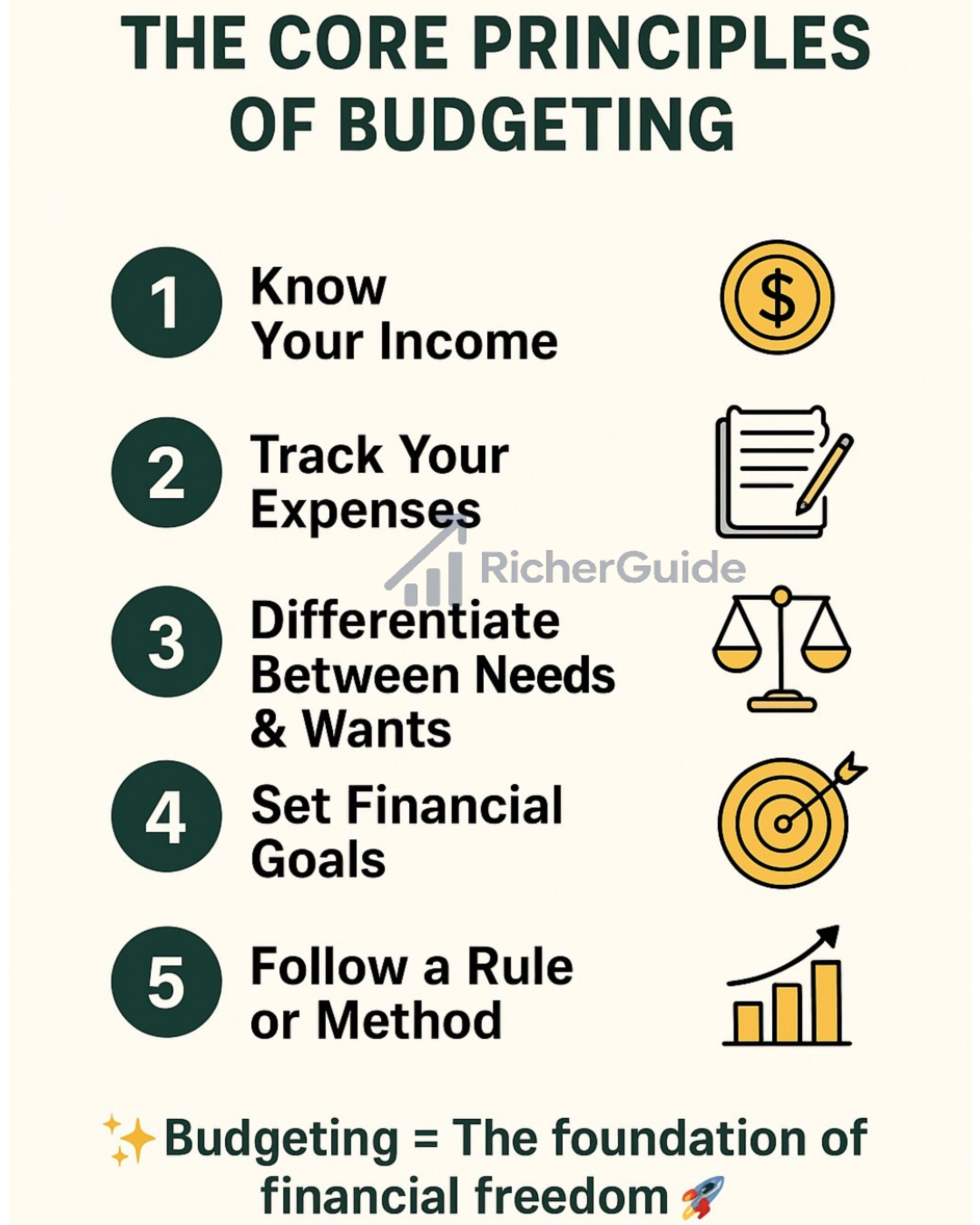

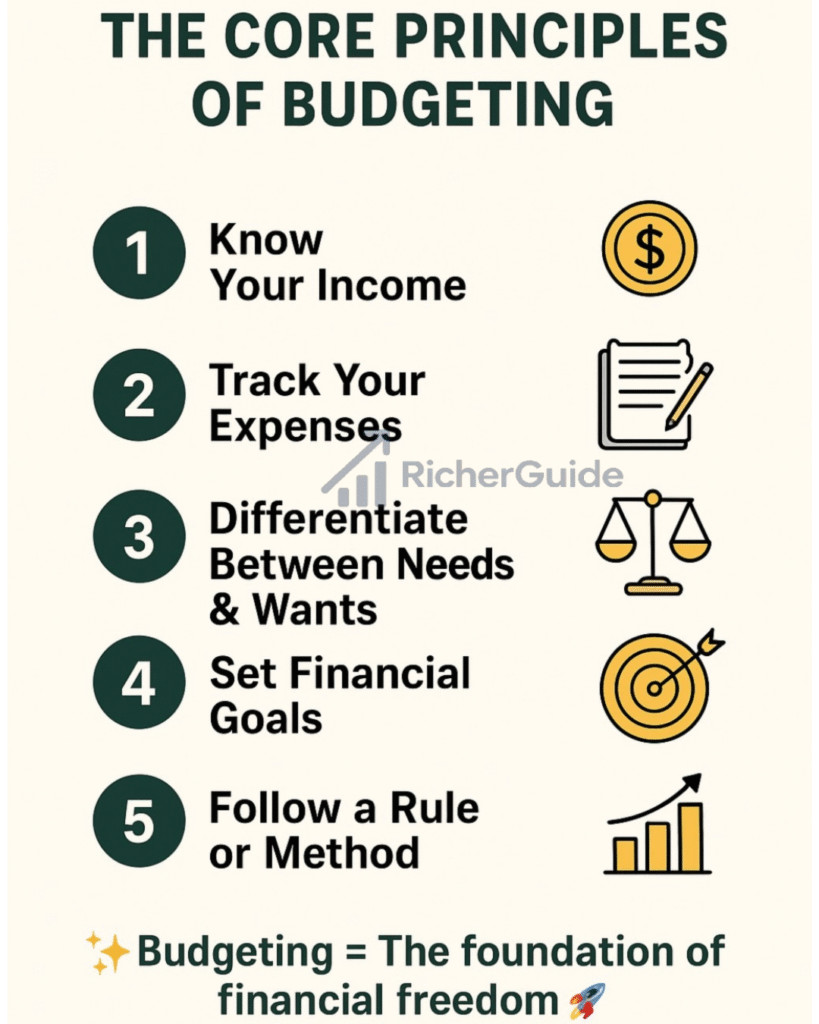

The Core Principles of Budgeting

1. Know Your Income

Start with your net income (after tax and deductions). Include all sources: salary, side jobs, rental income, etc. This is the actual amount you can spend or save.

2. Track Your Expenses

For at least one month, log every expense, big or small. This reveals spending patterns that you may overlook like daily coffees or subscriptions.

3. Differentiate Needs and Wants

Needs are essentials—food, housing, utilities. Wants are extras—dining out, gadgets, entertainment. Prioritize needs, then savings, and lastly wants.

4. Set Financial Goals

Write down what you want to achieve financially: pay off debts, save for a car, or plan for retirement. Goals give your budget direction.

5. Use a Budgeting Method

The popular 50/30/20 Rule is a great starting method:

- 50% of income: Needs

- 30% of income: Wants

- 20% of income: Savings/Debt repayment

Adjust percentages to fit your lifestyle.

How to Create Your First Budget

Follow these actionable steps:

- Calculate your monthly net income.

- List fixed monthly expenses: rent, loans, utilities, insurance.

- List variable monthly expenses: groceries, dining out, transport.

- Plan savings goals: aim for at least 20% of income.

- Compare income vs expenses and cut non-essentials if spending exceeds income.

- Track spending weekly to stay on track.

Common Budgeting Mistakes to Avoid

- Being unrealistic with limits.

- Ignoring small expenses.

- Not updating the budget regularly.

- Skipping savings altogether.

- Quitting budgeting too soon (it takes 2-3 months to get used to it).

Tips to Make Budgeting Simple and Effective

- Use free budgeting apps like Mint or create an Excel sheet.

- Automate savings to your bank or investment accounts.

- Reward yourself occasionally to maintain motivation.

- Include family in budgeting to avoid conflicts.

- Review your budget monthly and adjust as needed.

Long-Term Benefits of Budgeting

Though it may seem tedious at first, budgeting brings long-term financial freedom. You build discipline, save consistently, and watch your financial goals materialize. Budgeting turns from a chore into a valuable habit, empowering you to handle money as a powerful tool instead of a source of stress.

Frequently Asked Questions (FAQs)

Q: How often should I update my budget?

A: Ideally, review and update your budget monthly to reflect income or expense changes.

Q: What if my expenses constantly exceed income?

A: Identify discretionary spending to cut, increase income streams, or adjust savings goals temporarily.

Q: Are budgeting apps safe to use?

A: Reputable apps use encryption for security. Choose well-reviewed apps like Mint or YNAB.

Q: Can budgeting help me get out of debt?

A: Yes, budgeting helps allocate money toward debt repayment systematically while avoiding new debt.

Explore

- Explore more on budgeting strategies: Budgeting Category

- Learn about savings and investment: Financial Freedom Guide

- Recommended budgeting app: Mint

- Free budget planner tool: Canada’s Budget Planner

Final Thoughts

Budgeting is not about restricting joy but enabling your money to serve your life’s goals. Whether you earn a modest or large sum, a budget ensures your money works effectively. Today is the best day to start budgeting—small steps, consistent effort, and soon financial control will be within your grasp.