Money is not just about profits anymore. Today, more people want their money to do good for the planet and society, along with earning returns. This is where Sustainable & Green Investing comes in.

If you care about climate change, clean energy, fair business practices, and a better future, this type of investing may be perfect for you. The good news is you don’t need to be an expert to start.

Let’s understand sustainable investing in simple words and explore easy green investment ideas for new investors.

Table of Contents

What Is Sustainable Investing? (In Simple Words)

Sustainable investing means putting your money into companies that care about:

- 🌍 The environment

- 👩👩👧 People and society

- 🏢 Ethical and honest business practices

In short, you invest in businesses that try to do the right thing, not just make money.

These companies focus on:

- Reducing pollution

- Saving energy and water

- Treating employees fairly

- Following transparent and ethical rules

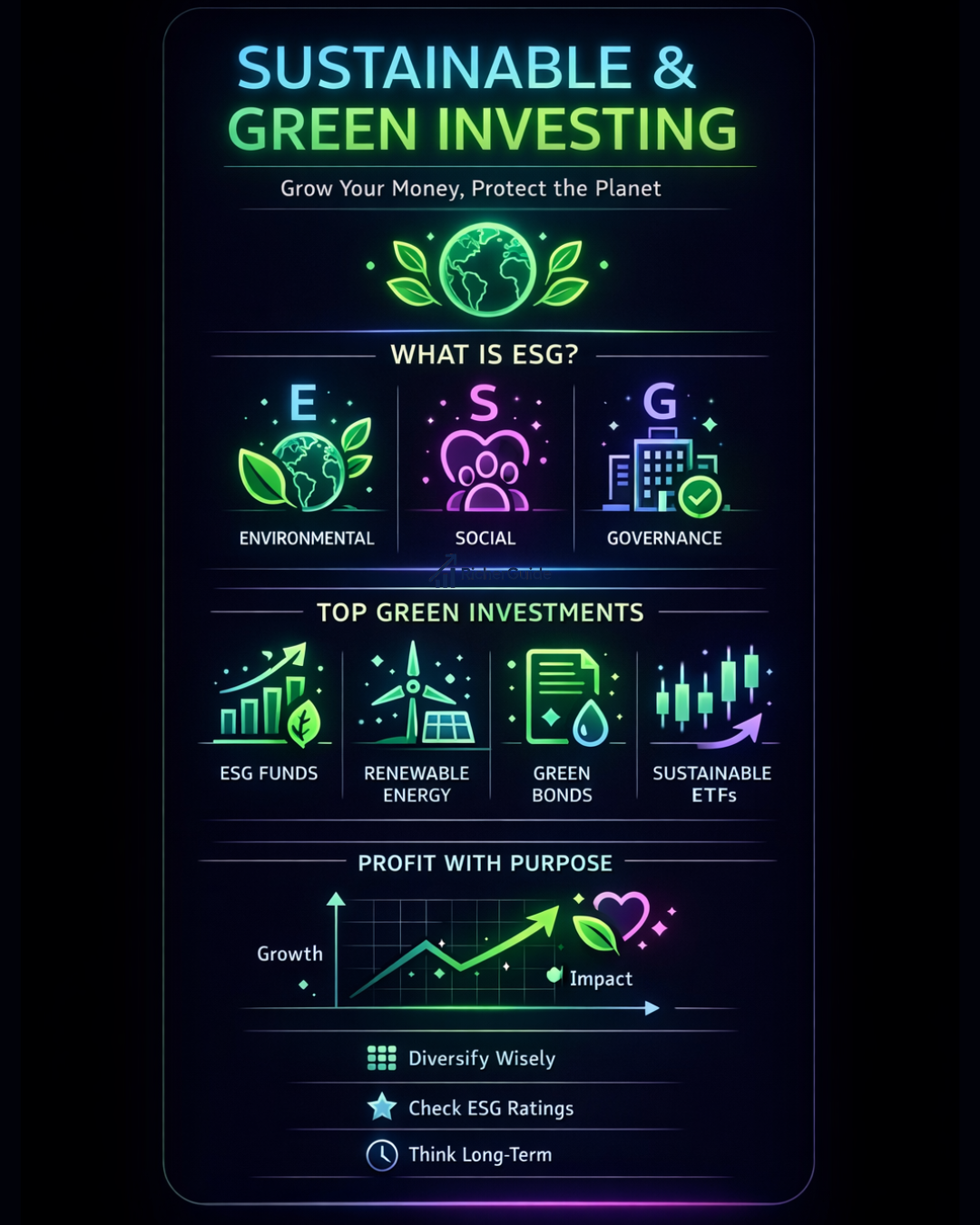

This type of investing is also called ESG investing.

What Does ESG Mean?

ESG stands for:

1. Environmental (E)

How a company impacts the environment.

Examples:

- Uses renewable energy

- Reduces carbon emissions

- Manages waste properly

2. Social (S)

How a company treats people.

Examples:

- Employee safety and fair wages

- Gender equality

- Customer and community care

3. Governance (G)

How a company is managed.

Examples:

- Honest leadership

- No corruption

- Transparent financial reporting

Companies with strong ESG practices are often more responsible and future-focused.

Why Are People Choosing Sustainable Investing?

Here are some key reasons why green investing is growing fast:

1. Care for the Planet

Climate change and pollution are real problems. Investors want to support companies that protect nature.

2. Long-Term Growth

Sustainable companies often plan for the future, making them more stable in the long run.

3. Lower Risk

Companies that follow rules and ethics face fewer legal and financial problems.

4. Aligns with Personal Values

Your money supports causes you believe in—clean energy, fairness, and sustainability.

Is Sustainable Investing Profitable?

Yes! Many people think green investing gives lower returns, but that is not true.

Studies show that ESG-focused companies often perform as well as or better than traditional companies over time. They adapt better to new laws, customer expectations, and future trends.

So you don’t have to choose between profits and purpose you can have both.

Top Green Investing Ideas for New Investors

If you are just starting, here are easy and beginner-friendly sustainable investment options.

1. ESG Mutual Funds

Best for: Beginners who want low effort investing

ESG mutual funds invest in a group of environmentally and socially responsible companies.

Why choose them:

- Professionally managed

- Diversified (lower risk)

- Easy to start with SIP

Example focus areas:

- Clean energy

- Ethical businesses

- Low-pollution companies

Perfect if you want simple and safe green investing.

2. ESG Index Funds

Best for: Low-cost, long-term investors

ESG index funds follow an index made up of top ESG-rated companies.

Benefits:

- Lower fees

- Transparent investments

- Ideal for long-term goals

They are similar to regular index funds but exclude companies involved in:

- Tobacco

- Weapons

- High pollution

3. Renewable Energy Stocks

Best for: Investors ready to take moderate risk

These companies work in:

- Solar energy

- Wind power

- Electric vehicles

- Battery technology

Why invest:

- Clean energy demand is rising

- Supported by government policies

- Long-term growth potential

Tip: Start small and diversify.

4. Green Bonds

Best for: Low-risk investors

Green bonds are loans given to projects that help the environment, such as:

- Solar plants

- Clean water projects

- Eco-friendly infrastructure

Benefits:

- Stable returns

- Lower risk than stocks

- Supports green development

Good option if you prefer steady income with purpose.

5. Sustainable ETFs

Best for: Easy diversification

ESG ETFs invest in many green and ethical companies at once.

Why they are great:

- Traded like stocks

- Lower expense ratio

- Good mix of companies

ETFs are ideal if you want flexibility and diversification.

How to Start Sustainable Investing (Simple Steps)

- Set Your Goal

Decide if you want long-term growth or stable income. - Choose the Right Option

Mutual funds, ETFs, stocks, or bonds. - Check ESG Ratings

Look for funds or companies with strong ESG scores. - Start Small

Begin with SIPs or small investments. - Stay Invested

Sustainable investing works best over time.

Things to Remember Before Investing

- Don’t invest just because something is “green”

- Always check fundamentals and performance

- Diversify your investments

- Think long-term

Sustainable investing is not a shortcut it is a smart and responsible strategy.

Final Thoughts

Sustainable & green investing allows you to grow your wealth while helping the planet. As climate awareness grows, responsible companies are becoming the future of investing.

Whether you are a beginner or a long-term investor, ESG investing gives you a chance to make a positive impact without sacrificing returns.

Your money has power. Use it wisely for your future and the planet’s future