Imagine your car breaks down unexpectedly, or a medical bill arrives out of the blue. What if you lose your job tomorrow?

These are stressful situations that can shake anyone’s financial stability, unless you have an emergency fund.

An emergency fund is a financial safety net. It offers peace of mind, knowing you have money set aside specifically for life’s surprises. Starting from zero? No worries. This guide will take you through the process of building your emergency fund one step at a time.

Table of Contents

What Is an Emergency Fund?

An emergency fund is money set aside solely for unexpected expenses or financial emergencies. It’s not for vacations, gadgets, or shopping.

Typical emergency scenarios include:

- Medical emergencies

- Job loss or significant income reduction

- Urgent home or car repairs

- Sudden family travel due to emergencies

Having this fund means you avoid debt, loans, or credit cards when the unexpected hits.

Why Is an Emergency Fund Important?

| Benefit | Explanation |

|---|---|

| Financial Security | Provides confidence and stability in uncertain times |

| Avoids Debt | Prevents reliance on high-interest credit cards and loans |

| Peace of Mind | Reduces anxiety, enabling better decision-making |

| Freedom to Plan | Focus on long-term goals without fear of short-term crises |

How Much Should You Save?

Experts generally recommend saving 3 to 6 months of your essential expenses.

If your monthly expenses are ₹40,000, your emergency fund should be between ₹1,20,000 and ₹2,40,000.

If your income is irregular or unstable, aim for 6 to 12 months’ expenses.

Start small—consistency over time builds the fund.

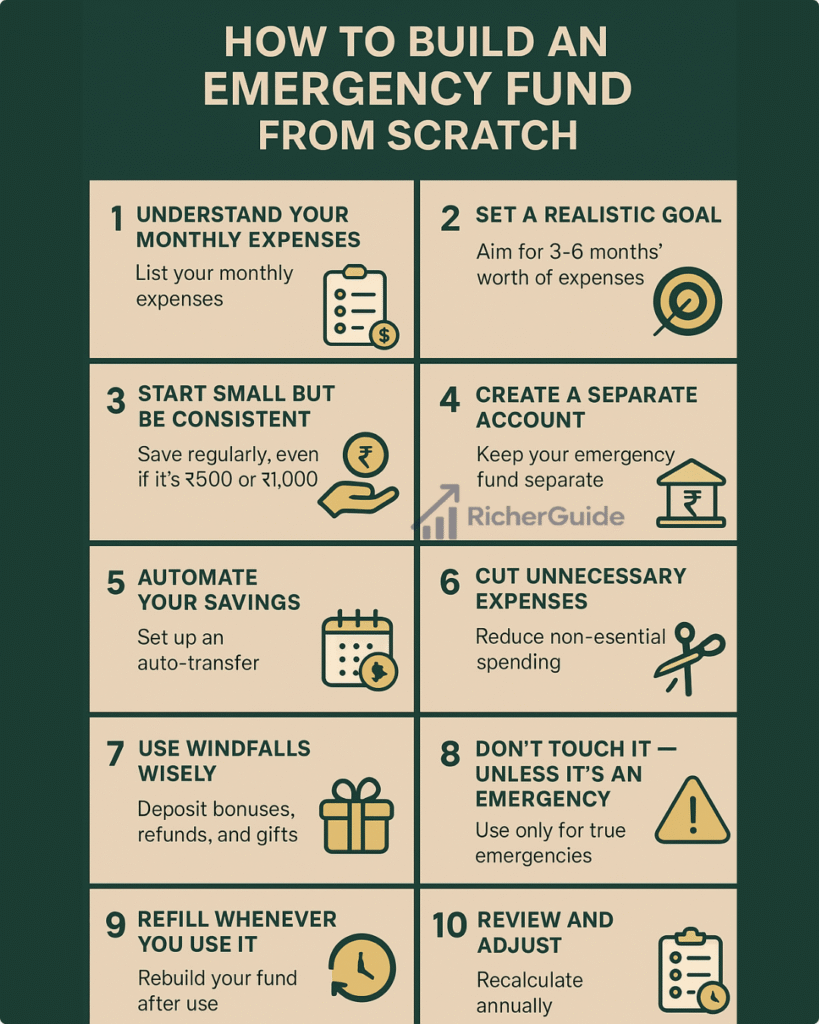

Step-by-Step Guide to Building Your Emergency Fund

| Step | Action | Details & Tips |

|---|---|---|

| Step 1 | Understand Your Monthly Expenses | List essentials: rent, groceries, transport, bills |

| Step 2 | Set a Realistic Goal | Break big goal into monthly targets (e.g., ₹10,000/month) |

| Step 3 | Start Small but Be Consistent | Even ₹500/month helps; consistency is key |

| Step 4 | Create a Separate Account | Keep fund separate to avoid temptation |

| Step 5 | Automate Your Savings | Set auto-transfer from your salary to savings |

| Step 6 | Cut Unnecessary Expenses | Trim takeouts, subscriptions, luxury spends |

| Step 7 | Use Windfalls Wisely | Allocate bonuses, tax refunds to the fund |

| Step 8 | Don’t Touch It Unless Emergency | Use strictly for true emergencies only |

| Step 9 | Refill Whenever You Use It | Quickly rebuild fund after any withdrawal |

| Step 10 | Review and Adjust | Annually adjust target based on lifestyle changes |

Where Should You Keep Your Emergency Fund?

Your emergency fund should be:

- Safe: Not exposed to loss risk

- Accessible: Easy access when needed urgently

- Earning: Some interest to grow over time

Good options:

| Account Type | Features |

|---|---|

| High-Yield Savings Account | Safe, liquid, earns interest |

| Liquid Mutual Funds | Better returns, easy redemption |

| Recurring Deposits (RD) | Good for gradual build-up, moderate returns |

Avoid risky investments like stocks for this fund due to volatility.

Final Thoughts

Building an emergency fund from scratch can feel overwhelming, especially with limited income. But every small step counts. Saving ₹500 a month can grow into a substantial safety net over time.

Discipline, patience, and consistency are your best allies. Once established, your emergency fund provides priceless peace of mind—the confidence to face life’s uncertainties without fear.

Start today: open a dedicated savings account, set a goal, and make your first deposit. Your future self will thank you.