Inflation affects everyone—whether you’re shopping for groceries, saving for retirement, or planning investments. Understanding inflation is crucial for protecting your finances and growing your wealth over time. This blog explains inflation, its impact on various financial areas, strategies to beat it, and answers common questions. You’ll find helpful links to RicherGuide’s expert advice, authoritative sources, practical tips, and visuals for easy learning.

Table of Contents

What is Inflation?

Inflation is the increase in prices of goods and services over time, which means your money buys less than it did before. For instance, if a loaf of bread costs ₹30 last year and ₹35 today, inflation has occurred. Economists track it using the inflation rate—a percentage that shows how quickly costs rise. Moderate inflation (2–4% per year) is normal and can help economies grow, but high inflation reduces your purchasing power.

Causes of Inflation

- Demand-pull: More people want goods and services than what’s available.

- Cost-push: Rising production costs lead to higher prices.

- Money supply: More money in the economy can drive up costs.

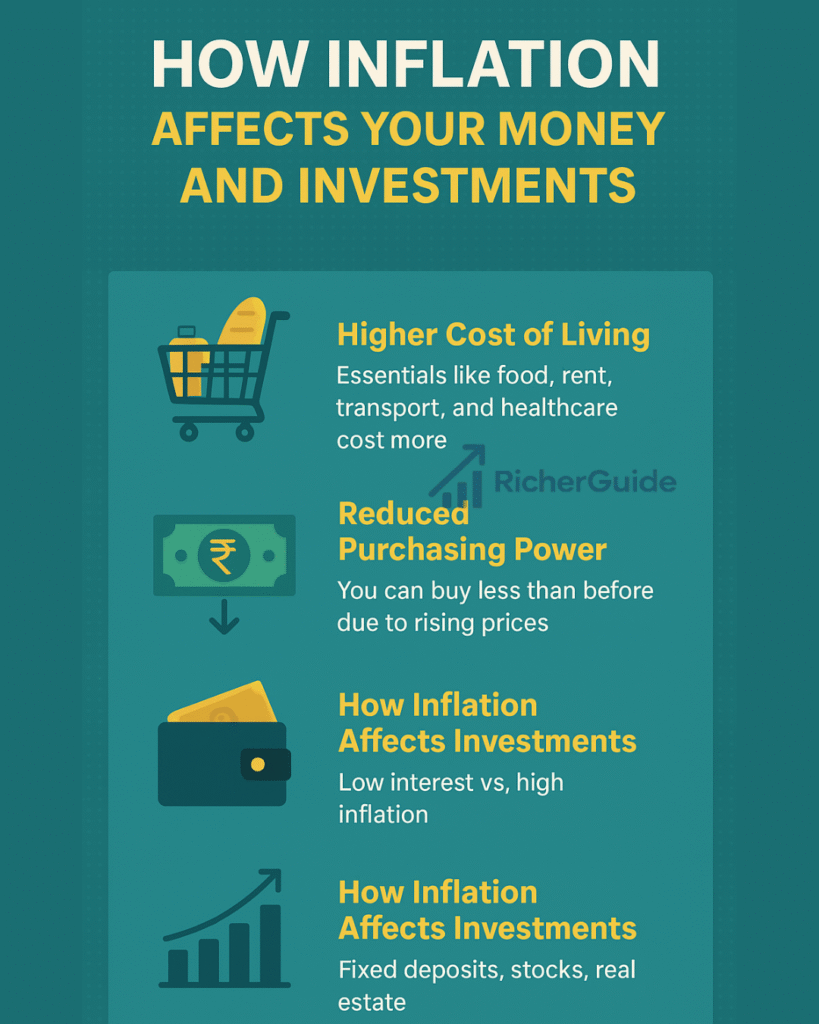

How Inflation Impacts Daily Life

Inflation touches almost everything you buy—groceries, rent, fuel, and more. As prices rise, you may need to adjust your lifestyle and budget.

- Cost of Living: Essentials become more expensive, leaving less money for saving or leisure.

- Purchasing Power: ₹1,000 saved five years ago won’t buy as much today.

- Lifestyle Changes: Many cut back on non-essentials and rework budgets to keep up with price hikes.

Impact on Savings

Inflation can erode the value of your savings, especially if your returns are low.

- Low Interest vs. High Inflation: If your savings earn 3% but inflation is 6%, your real wealth decreases.

- Emergency Funds: While emergencies need cash, too much idle money loses value with inflation.

- Tip: Choose accounts with competitive rates and review options like fixed deposits, debt mutual funds, and inflation-linked bonds.

Impact on Investments

Inflation reduces the real returns on investments. Understanding how each option reacts to rising prices helps you safeguard your portfolio.

Inflation and Retirement

Long-term goals like retirement are most at risk. If you plan for today’s prices, inflation may leave you short down the road.

- Example: ₹50,000/month budget today may need over ₹1.6 lakh/month in 20 years (at 6% inflation).

- Tip: Plan for retirement with inflation-adjusted estimates.

Protecting Your Money

Beat inflation with strategic planning:

- Invest in assets like stocks, equity mutual funds, and real estate for higher returns.

- Diversify your investments to spread risk.

- Boost income through career growth or side hustles.

- Use inflation-linked bonds for protection.

- Track spending and savings, adjusting regularly based on inflation rates.

- Factor inflation into long-term financial goals like retirement and education.

The Positive Side of Inflation

Controlled inflation encourages people to invest and spend, helping economies and asset values to grow. It’s only problematic when it’s too high or unpredictable.

Frequently Asked Questions

1. What is a healthy rate of inflation?

A 2–4% annual inflation rate is considered healthy for most economies.

2. How can I protect my savings from inflation?

Invest in assets like stocks, diversified mutual funds, or real estate. Avoid keeping all your money in low-interest accounts.

3. Is gold a good hedge against inflation?

Gold can protect wealth during inflation, but it doesn’t provide ongoing income. Consider gold ETFs to avoid storage hassles.

4. Should I keep large emergency funds in cash?

Maintain enough cash for emergencies, but invest surplus funds for better returns.

5. How does inflation impact retirement?

Over time, inflation increases the cost of living, so plan your retirement using higher inflation assumptions.

Final Thoughts

Inflation is a silent but powerful force that can eat into your savings and investments. You can’t control rising prices, but you can control how you manage and grow your money. By staying informed, investing wisely, diversifying, and planning for inflation, you ensure your wealth grows faster than inflation—securing your financial future.

Useful Links: