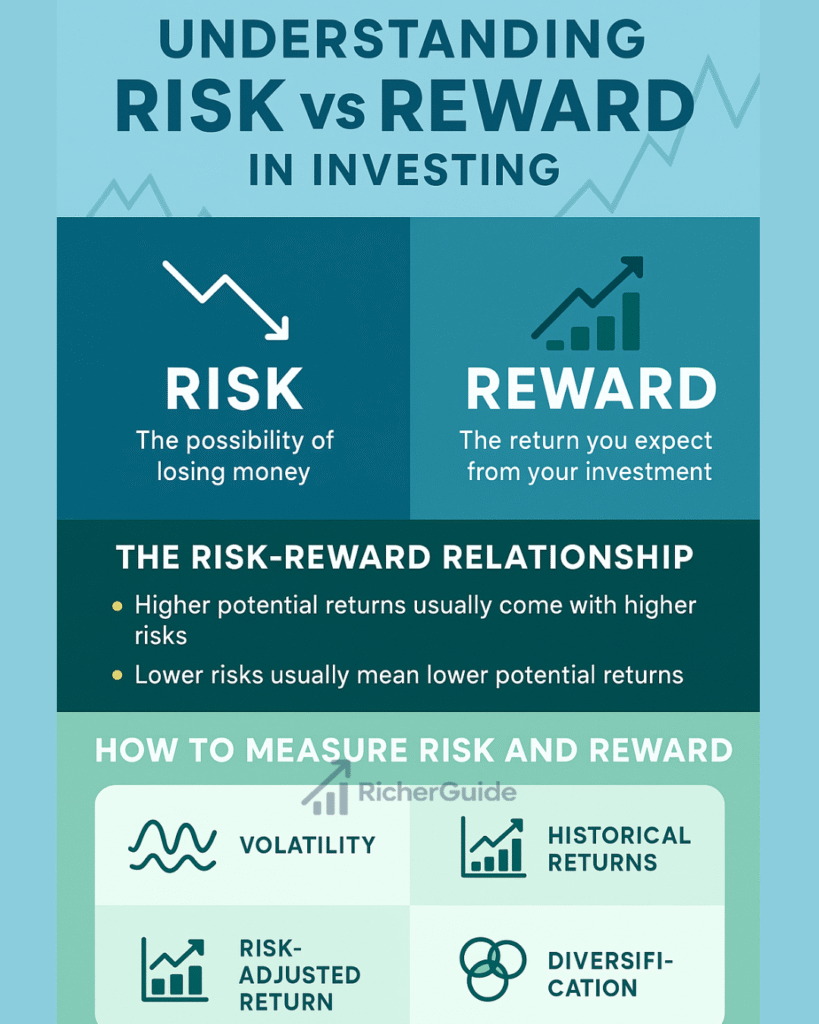

When most people think of investing, they picture making money. But investing isn’t just about returns—it’s equally about risk. Every investment decision carries two sides of the same coin: risk and reward. Understanding how these two work together is the foundation of smart, confident investing.

In this guide, we’ll explore what risk and reward mean, how they connect, and how to manage them effectively.

Table of Contents

What is Risk in Investing?

Risk is the possibility of losing money or not earning the expected return. Investment values can fluctuate because of factors like market volatility, company performance, inflation, or global events.

Common Types of Investment Risks

| Type of Risk | Description |

|---|---|

| Market Risk | Prices of stocks, bonds, or mutual funds fall due to overall market movements. |

| Credit Risk | A borrower (company or government) fails to pay back debt. |

| Inflation Risk | Returns don’t keep up with inflation, reducing purchasing power. |

| Liquidity Risk | Difficulty in selling investments quickly (e.g., real estate). |

| Business Risk | Poor company performance causes the stock value to drop. |

Summary: Higher risk means more uncertainty—but often, more opportunity.

What is Reward in Investing?

Reward refers to the profit or gain you expect from an investment. Returns can come as interest, dividends, or capital appreciation.

Example Comparison

| Investment Type | Risk Level | Expected Reward |

|---|---|---|

| Savings Account | Very Low | Low interest return |

| Government Bonds | Low | Modest return |

| Stocks | Medium to High | High long-term potential |

| Startups | Very High | Potentially very high or total loss |

The goal isn’t to avoid risk entirely—but to ensure the reward justifies it.

The Risk-Reward Relationship

The golden rule of investing:

Higher potential returns come with higher risks.

Lower risks usually mean lower potential returns.

Illustration idea: A line graph showing increasing risk on the X-axis and potential reward on the Y-axis.

Example:

- Government Bonds: Low risk, steady returns.

- Startup Investments: High risk, potentially huge returns—or total loss.

This relationship shapes how investors allocate money depending on their comfort level and financial goals.

How to Measure Risk and Reward

Savvy investors use several tools to evaluate this balance:

| Tool | Purpose |

|---|---|

| Volatility | Tracks price fluctuations—higher volatility = higher risk. |

| Historical Returns | Uses past data to estimate potential gains. |

| Sharpe Ratio | Assesses risk-adjusted performance. |

| Diversification | Spreads investments to lower overall risk. |

Why Understanding Risk vs Reward Matters

Knowing the balance helps you:

- Avoid major losses through overexposure.

- Make confident, informed investment choices.

- Align investments with your financial goals.

- Protect and grow wealth simultaneously.

Ignoring this relationship often leads to emotional or short-sighted decisions.

Matching Risk with Your Investor Profile

Your risk tolerance depends on several personal factors:

| Factor | Impact on Risk Tolerance |

|---|---|

| Age | Younger investors can take more risk. |

| Income & Savings | Financial stability = more room for risk. |

| Goals | Short-term goals need safer investments. |

| Personality | Comfort with volatility matters. |

Example:

- A 25-year-old saving for retirement might invest 70% in stocks and 30% in bonds.

- A 55-year-old nearing retirement may prefer 30% in stocks and 70% in bonds for stability.

Balancing Risk and Reward

Tips to manage risk wisely:

- Diversify: Spread across asset classes to reduce exposure.

- Start Small: Test your comfort with risk using small amounts first.

- Think Long-Term: Markets reward patience.

- Stay Rational: Avoid panic-selling or greedy buying.

- Review Often: Rebalance your portfolio every few months.

Real-Life Example

Meet Amit and Riya:

| Investor | Strategy | Outcome After 20 Years |

|---|---|---|

| Amit | Only savings account | Safe but low returns, loses value to inflation. |

| Riya | Mix of stocks and bonds | Portfolio fluctuates, but significantly outperforms savings. |

Lesson: Avoiding risk feels safe but limits growth. Controlled risk-taking builds wealth.

Final Thoughts

Investing is like walking a tightrope—you need balance.

Too much risk, and you may fall. Too little, and progress halts.

The key is knowing yourself: your goals, comfort, and time horizon. Combine diversification, discipline, and patience to strike the right balance.