Managing money wisely starts with understanding one of the most fundamental concepts in personal finance: the difference between needs and wants. While the distinction may seem obvious, distinguishing the two clearly can often be challenging when budgeting or controlling expenses. This misunderstanding can lead to overspending and difficulty saving money.

Table of Contents

What Are Needs?

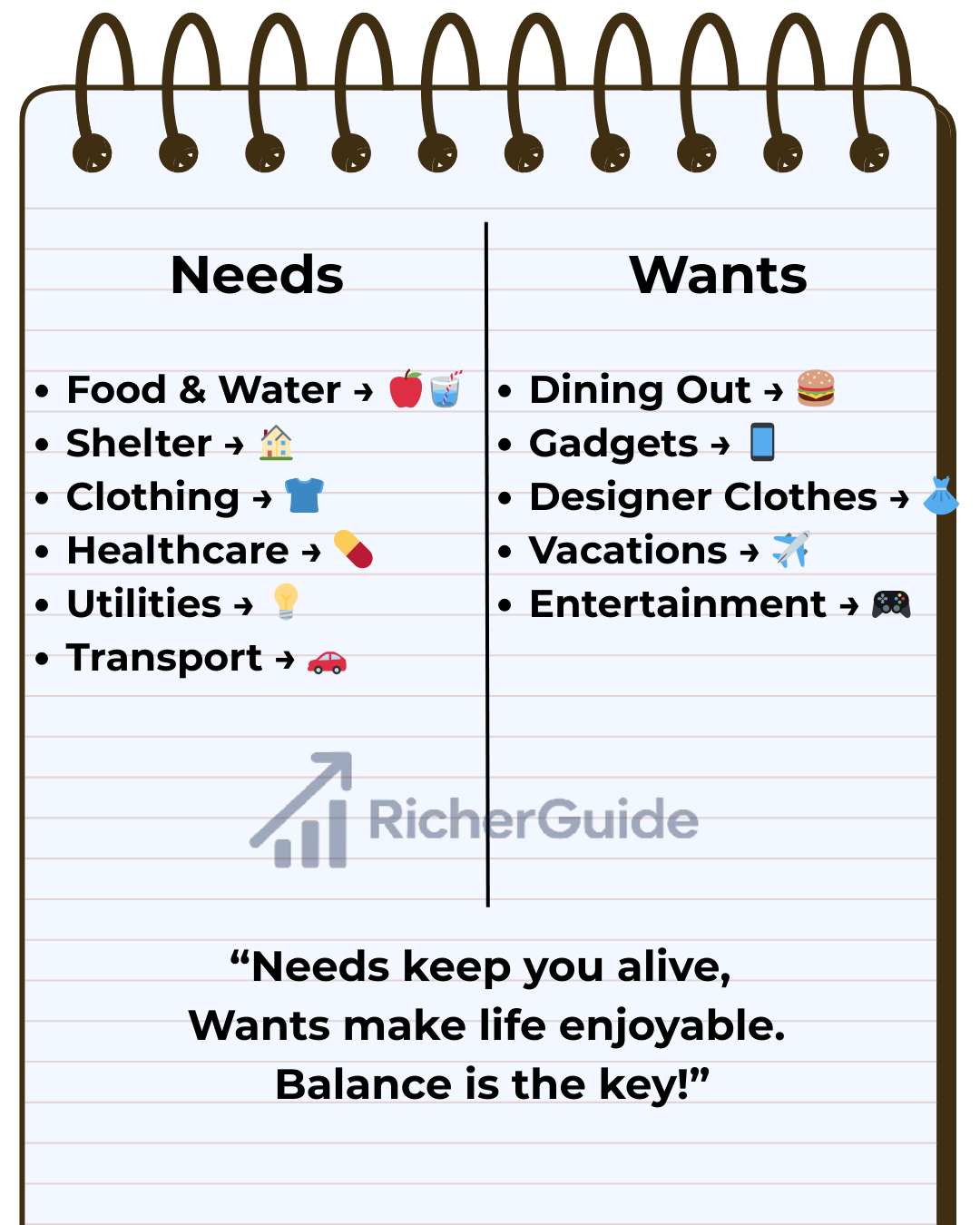

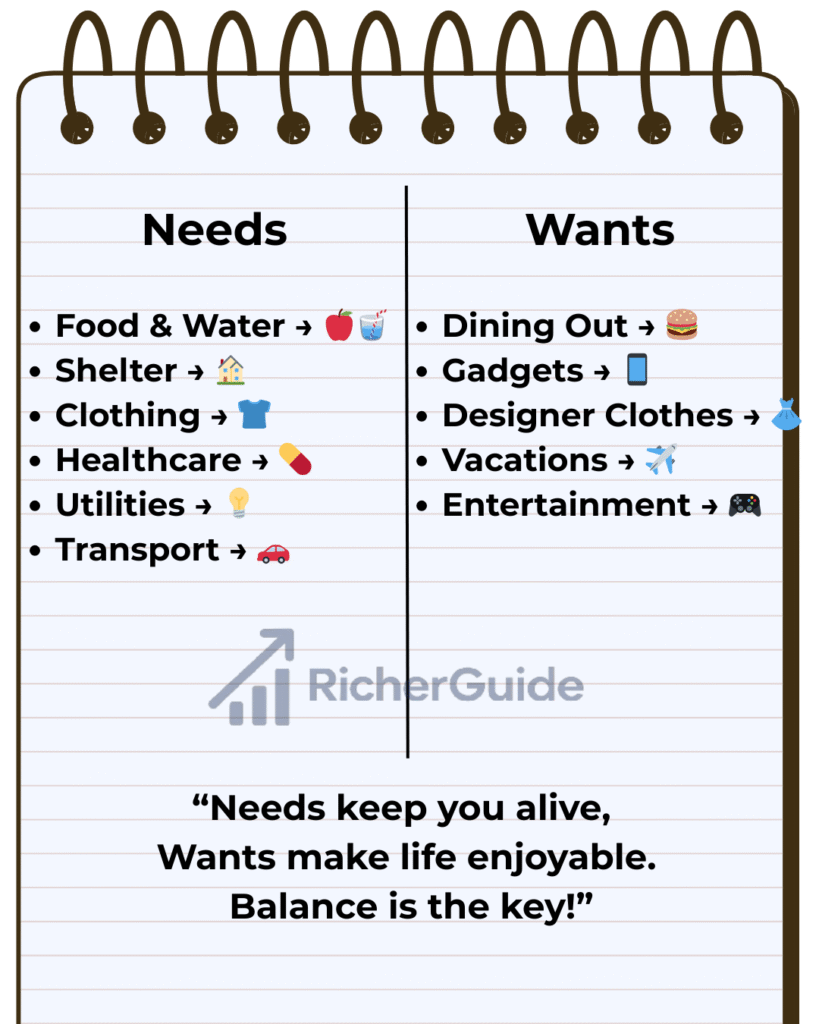

Needs are essential items or services necessary for survival and maintaining a basic quality of life. Missing these can jeopardize your health, safety, or well-being.

Common needs include:

- Food and water — critical for nutrition and health.

- Shelter — a safe place to live.

- Clothing — for protection and comfort.

- Utilities — electricity, water, and heating.

- Healthcare — necessary medical needs and treatments.

- Transportation — essential to get to work, school, or healthcare.

Needs are about function, not luxury. For example, basic shoes are a need, expensive designer sneakers are a want.

What Are Wants?

Wants are non-essential desires that enhance your comfort, enjoyment, or lifestyle but are not vital for survival.

Examples of wants include:

- Dining out or ordering takeout regularly.

- Latest gadgets or frequent phone upgrades.

- Designer clothes and luxury accessories.

- Vacations and travel.

- Streaming services, gaming, and other entertainment subscriptions.

Wants are not bad but require balance; overspending on wants can undermine your financial goals.

Why It Matters to Know the Difference

Understanding the distinction helps you:

- Budget effectively by prioritizing needs.

- Save more by reducing unnecessary spending.

- Avoid debt caused by confusing wants for needs.

- Reduce financial stress through prioritization.

- Make conscious, smart spending choices.

This clarity is the foundation of good money management.

How to Separate Needs from Wants

- Ask: “Is this essential for me to survive or function daily?”

- Think long-term: Needs have lasting impact; wants often provide short-lived pleasure.

- Check emotions: Wants are often impulse-driven.

- Use the 24-hour rule: Wait before purchasing to judge true necessity.

- Follow budgeting rules: Use frameworks like the 50/30/20 rule (50% needs, 30% wants, 20% savings).

Real-Life Examples

| Category | Needs | Wants |

|---|---|---|

| Housing | Rent or mortgage payments | Luxury apartments with extra amenities |

| Transportation | Basic car or public transit | Sports car or luxury SUV |

| Food | Groceries for cooking | Dining at restaurants frequently |

| Clothing | Weather-appropriate clothing | High-end fashion or branded items |

Finding the Right Balance

- Cover your needs first.

- Set a reasonable budget for wants to enjoy life.

- Plan and save for big-ticket wants to avoid debt.

- Review and track expenses regularly.

Balance ensures you live comfortably today while securing your financial future.

FAQ

Q1: Can wants become needs?

Sometimes, yes. A phone is a need, but upgrading every year is a want. If your job requires specific tools or clothing, these may be needs for you.

Q2: How strict should I be separating needs and wants?

Aim for a healthy balance. Prioritize needs, but don’t eliminate all wants—moderate spending on wants can improve your quality of life.

Q3: What if my job or lifestyle changes my needs?

Needs can vary individually. Reassess your budget regularly to update your list of needs and wants.

Q4: How can I control impulse buys?

Try the 24-hour rule: wait a day before purchasing non-essential items. Also, stick to your budget and track expenses closely.

Important Links

- budgeting tips post: How to Create a Budget That Works for You

- saving money strategies: Smart Ways to Save More Each Month

- budgeting frameworks: Better Money Habits: Budgeting Basics

- psychology behind spending: Psychology of Needs and Wants

Final Thoughts

Distinguishing between needs and wants is a simple but powerful step toward smarter spending. Prioritizing your essentials while balancing enjoyment can reduce financial stress, prevent debt, and accelerate your path to savings goals. Always pause and ask yourself, “Is this a need or a want?” before making your next purchase. Your finances and future self will thank you.