We all start budgeting with good intentions. A new notebook, an app, or maybe even an Excel sheet with full of plans on how to control spending and save more. But after a few weeks, most people give up. Why does this happen? Is budgeting really so difficult?

The truth is, budgeting is less about numbers and more about psychology. Our habits, emotions, and mindset play a big role in how we handle money. Let’s explore the psychology of budgeting, why most people fail, and how you can succeed.

Table of Contents

Why People Start Budgets but Don’t Stick to Them

1. Emotions Drive Spending

Money isn’t just about logic. Emotions like happiness, stress, or even boredom can make us spend.

Example: Ritu, a college student, creates a strict monthly budget. But after a tough exam, she rewards herself with online shopping worth ₹2,000. This breaks her budget.

When emotions take over, discipline takes a back seat.

2. The “Tomorrow I’ll Save” Mentality

Many believe in adjusting “next month.”

Example: Rajesh promises to save ₹5,000 after Diwali shopping. But the next month comes with another wedding in the family. The cycle continues.

We assume we’ll save later, but “later” rarely comes?

3. Underestimating Small Expenses

We often ignore small spends like chai, snacks, or UPI payments. But these add up.

Example: Sameer, a IT professional buys a ₹40 coffee daily. In a month, that’s ₹1,200—almost equal to a mutual fund SIP!

This is called the “small leak effect” in budgeting psychology.

4. Unrealistic Budgets

Some people create budgets that are too strict. They cut out every entertainment or food expense. This feels like punishment, not planning.

Example: Meena decides to stop eating out completely to save money. Within two weeks, she feels deprived and ends up splurging on a ₹3,000 dinner.

Budgets that are too strict usually fail.

5. Cultural and Social Pressure

social obligations often break budgets. Weddings, festivals, birthdays, and family gatherings come with spending expectations.

Example: Even if Sunil wants to save, he feels pressured to give expensive gifts at a cousin’s wedding. He overspends and his budget collapses.

Peer pressure plays a huge role in our financial decisions.

6. Lack of Financial Awareness

Many people don’t track where their money goes. They only realize at month-end that the salary has vanished.

Example: Shweta, a teacher, doesn’t record her expenses. She feels she’s spending “only on needs” but at the end of the month, she has nothing left.

Without awareness, no budget works.

The Psychology Behind Budget Failure

- Instant Gratification vs. Long-Term Goals

Human brains are wired to seek immediate happiness. Saving for retirement in 25 years feels less urgent than buying a new phone today. - Optimism Bias

We think we’ll “earn more later,” so we don’t worry about overspending today. But salary hikes often come with lifestyle inflation. - Habit Formation

Budgeting requires habit, like brushing your teeth. Most people quit before it becomes automatic. - Loss Aversion

Psychology says we hate losing more than we love gaining. A budget feels like “losing” freedom, so we avoid sticking to it.

How to Overcome Budgeting Failures

1. Start Small and Simple

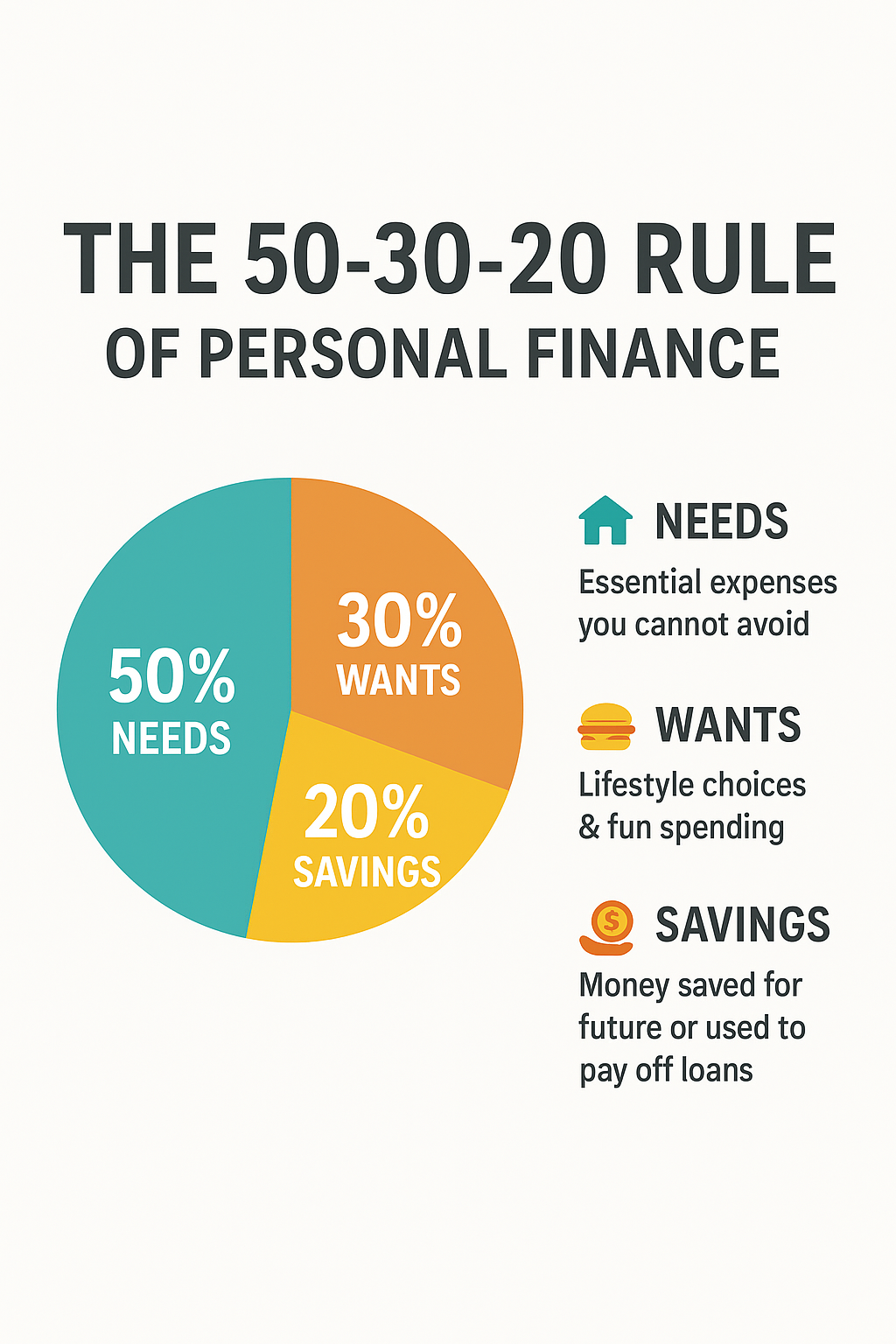

Instead of tracking every rupee, start with just three categories: Needs, Wants, Savings. The popular 50-30-20 rule works.

- 50% for needs (rent, groceries, bills)

- 30% for wants (movies, eating out, shopping)

- 20% for savings & investments

2. Use the Right Tools

- UPI apps like PhonePe and Paytm now show expense summaries.

- Budgeting apps like Walnut and Money View make tracking easy.

When you see your spending visually, it’s easier to control.

3. Automate Savings

Set up an automatic SIP or recurring deposit at the start of the month. When money leaves your account before you spend, budgeting feels easier.

4. Reward Yourself

Don’t make your budget a punishment. Keep a small “fun budget” for movies, street food, or shopping. This helps you stick to the bigger plan.

5. Plan for Realities

Festivals, weddings, and family functions are part of life. Instead of ignoring them, include them in your yearly budget. Create a “social expenses” fund.

6. Track Progress, Not Perfection

It’s okay if you overspend sometimes. The goal is to improve month by month, not be perfect from day one.

Realistic Example: The Sharma’s Family

The Sharma’s family struggled with budgeting. They always overspent during festivals and weddings. After learning about the 50-30-20 rule, they started allocating money properly:

- Needs: ₹40,000

- Wants: ₹24,000

- Savings/Investments: ₹16,000

They also created a ₹50,000 yearly “festival fund.” Now, they enjoy celebrations without breaking their budget.

Conclusion

Budgeting is not just about numbers; it’s about psychology. Most people fail because they fight against their own habits and emotions. The key is to understand your spending behavior, start small, and create realistic budgets that match your lifestyle.

“A budget is not a jail, it’s a map” It doesn’t restrict you; it guides you to financial freedom.