When most people hear the word investing, they imagine stock markets, billionaires, or big businesses moving huge amounts of money. However, the truth is that investing is not just for the rich. It is for anyone who wants to grow their money, secure their future, and achieve financial freedom.

In this step-by-step guide, we’ll break down what investing really means, why it matters, and how even a beginner with limited money can start today.

Table of Contents

Step 1: Understand What Investing Really Means

At its core, investing is putting your money to work so it grows over time. Instead of keeping money idle in a savings account, you place it in assets like stocks, mutual funds, bonds, real estate, or even small businesses.

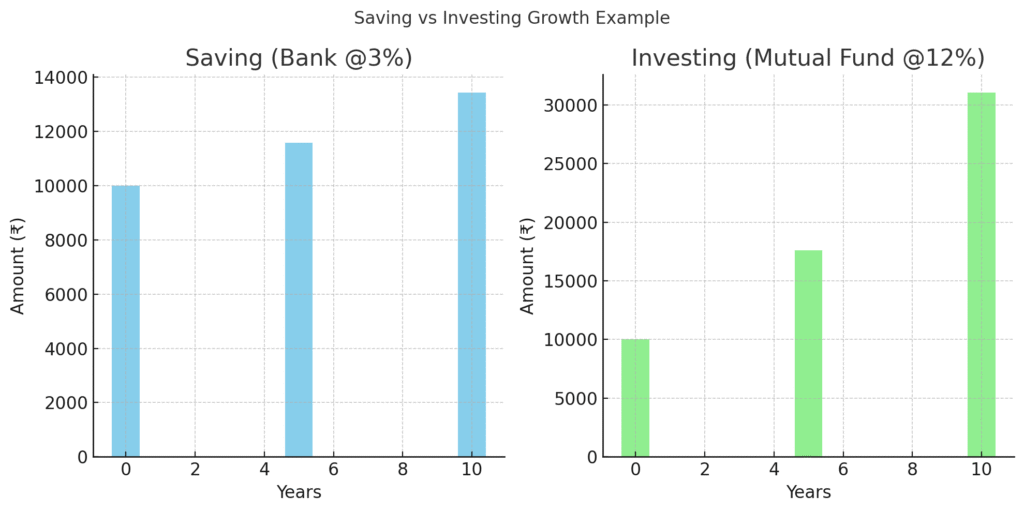

Example: If you keep ₹10,000 in a savings account at around 2%-3% interest, after one year you’ll have ₹10,300. By contrast, if you invest that same ₹10,000 in a mutual fund with an average 12% return, it could grow to ₹11,200 in a year. Over 10 years, the difference is huge.

Step 2: Break the Myth – “Investing is Only for the Rich”

This is one of the biggest misconceptions about investing. In reality, you don’t need lakhs of rupees to start. Today, thanks to digital platforms, you can begin with as little as ₹100 or ₹500.

| Myth | Reality | Example |

|---|---|---|

| You need a lot of money to invest | You can start small | SIPs (Systematic Investment Plans) allow investing from ₹500/month |

| Only finance experts can invest | Anyone can learn | Apps and online guides make it beginner-friendly |

| Investing is risky | Risk is manageable | Diversifying reduces risk |

Step 3: Learn the Difference Between Saving and Investing

Many people confuse saving with investing. But in practice, they are very different.

| Saving | Investing |

|---|---|

| Money kept aside for safety | Money put into assets for growth |

| Low or no risk | Some level of risk |

| Returns are fixed but small | Returns can be higher over time |

| Example: Bank FD | Example: Stock market, mutual funds |

Example: Saving is like keeping food in a fridge. On the other hand, investing is like planting seeds in soil. One keeps it safe, the other makes it grow.

Step 4: Types of Investments Everyone Can Start With

If you are just beginning, here are simple options to consider:

- Mutual Funds (SIPs): Invest a small amount monthly, managed by experts.

- Stock Market: Buy shares of companies you believe in.

- Fixed Deposits (FDs): Low risk, small growth.

- Gold (Digital Gold/ETFs): Traditional but now easy to buy online.

- Real Estate (REITs): Small investments in property through digital platforms.

As a result, you can pick an option that matches your comfort level.

Step 5: Start Small – A Practical Example

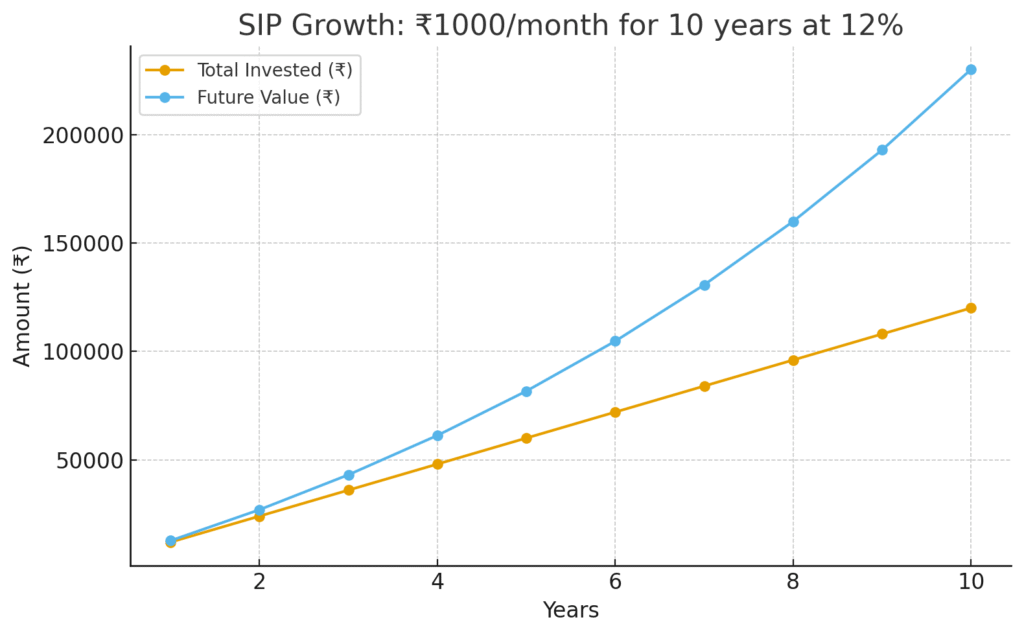

Imagine you invest ₹1,000 every month in a mutual fund for 10 years.

- Monthly Investment: ₹1,000

- Total Invested in 10 Years: ₹1,20,000

- Average Return: 12% annually

- Final Value after 10 Years: ₹2,32,339

Therefore, even with small steps, you can double your money without being “rich.”

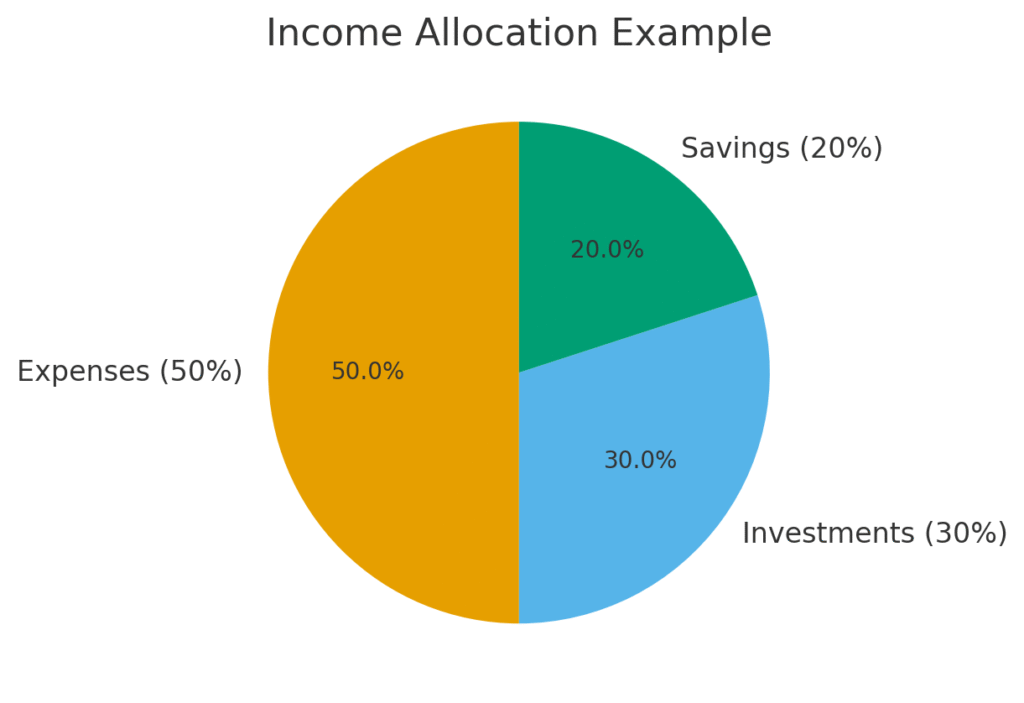

Step 6: Use a Simple Investment Template

Here’s a beginner-friendly template you can copy:

| Month | Income | Savings (20%) | Investment (30%) | Expenses (50%) |

|---|---|---|---|---|

| January | ₹30,000 | ₹6,000 | ₹9,000 | ₹15,000 |

| February | ₹30,000 | ₹6,000 | ₹9,000 | ₹15,000 |

This way, you can allocate money wisely without stress.

Step 7: Manage the Risk

Yes, investing involves risk, but fortunately, you can control it.

- Diversify: Don’t put all money in one stock.

- Start small: Even ₹500 SIPs make a difference.

- Stay patient: Investing is a long-term game.

Example: If you invest ₹500 in a SIP and the market goes down one month, don’t panic. Eventually, over 5–10 years, it balances out.

Step 8: Think Long-Term

The power of investing comes from compound growth.

Example: If you invest ₹5,000 per month for 20 years with a 12% return, you’ll invest ₹12,00,000 but end up with ₹49,95,000+.

Therefore, patience is key.

Step 9: Why You Should Start Today

- Inflation reduces the value of money.

- Early investing gives more time for compounding.

- You don’t need to be rich to start.

For instance, a 25-year-old starting with ₹2,000/month has a better future than a 35-year-old starting with ₹10,000/month, thanks to time.

Final Thoughts

Investing is not about being rich. Instead, it’s about making smart decisions with whatever money you have. By starting small, staying consistent, and thinking long-term, anyone can build wealth.

If you’ve been wondering what is investing and why it’s important, remember this—investing is for everyone, not just the wealthy. Start today, even with ₹100, and your future self will thank you.

One thought on “9 Steps Investing Is Not Just for the Rich”