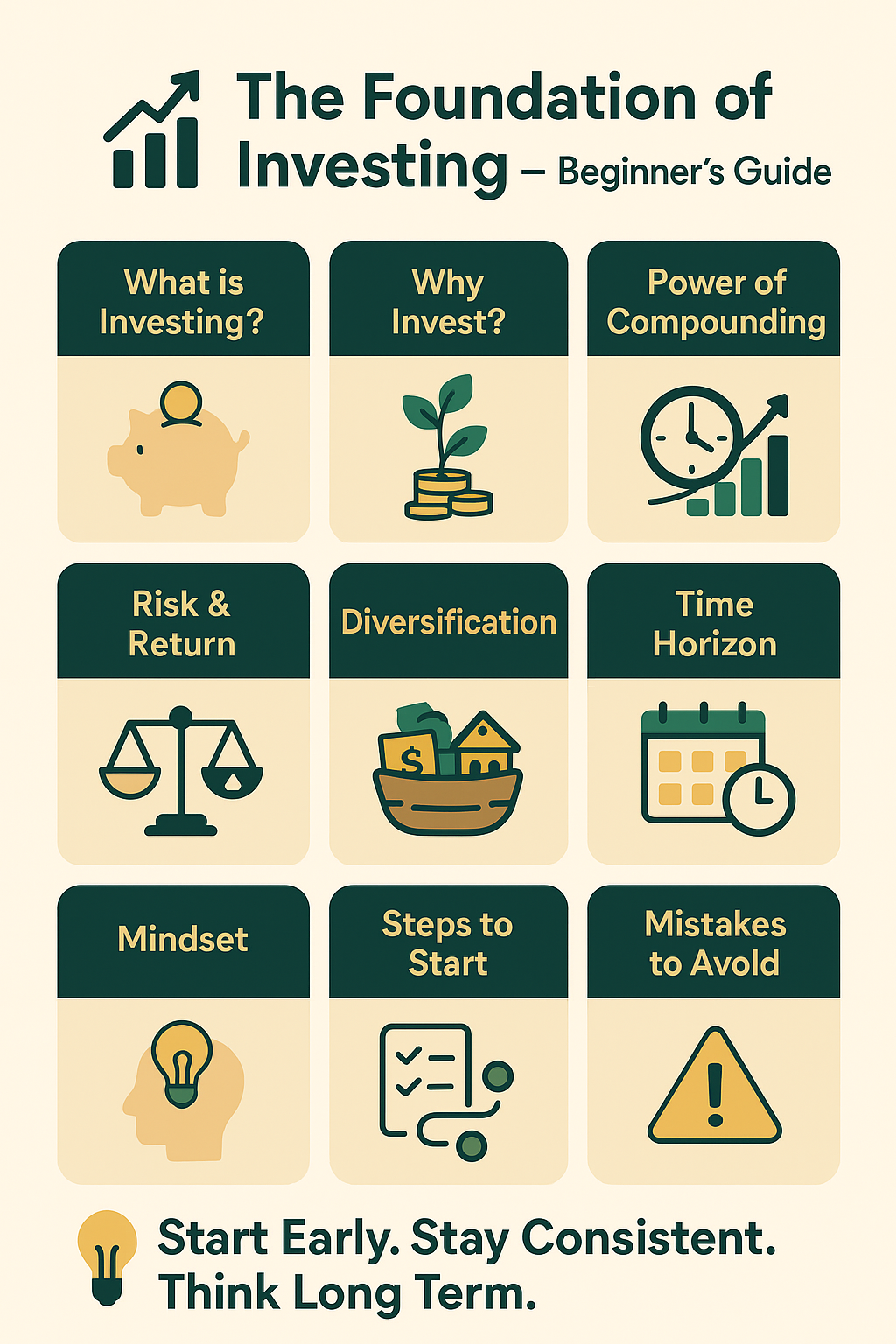

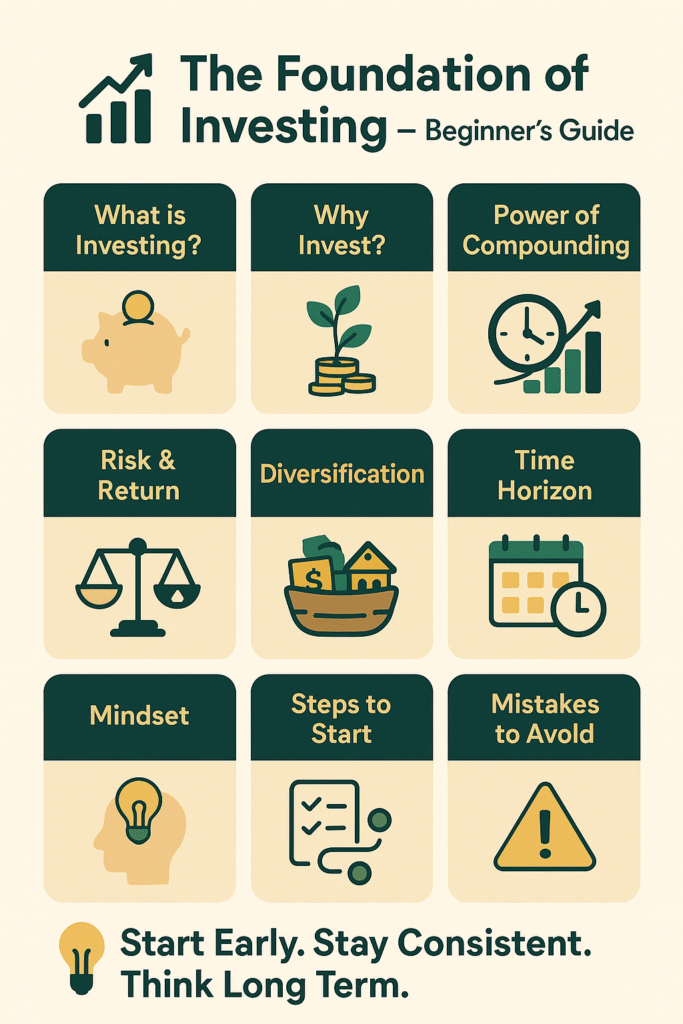

Investing is one of the most powerful ways to build wealth and secure your financial future. Whether you dream of buying a house, sending your kids to college, or retiring comfortably, investing can help turn those dreams into reality. But for many beginners, the word “investing” feels complicated, full of jargon and risks. The good news is that you don’t need to be a financial expert to get started. All you need is a clear understanding of the basics—the foundation of investing.

In this blog, we’ll break down the core principles of investing in simple language so that anyone can understand and apply them.

Table of Contents

1. What is Investing?

At its simplest, investing means putting your money to work so that it grows over time. Instead of keeping all your money in a savings account, where it earns very little interest, you use it to buy assets that can increase in value or generate income.

Examples of investments include:

- Stocks – owning a small piece of a company.

- Bonds – lending money to governments or corporations in exchange for interest.

- Real estate – buying property to rent or sell for profit.

- Mutual funds/ETFs – pooling money with others to invest in a mix of assets.

The key difference between saving and investing is that saving keeps your money safe, while investing aims to grow it.

2. Why Should You Invest?

Inflation slowly reduces the value of money. If you keep ₹1,000 under your mattress today, in 10 years it won’t buy as much as it does now. Investing helps your money grow faster than inflation, ensuring your wealth increases in real terms.

Here are some benefits of investing:

- Wealth creation: Your money grows through compounding.

- Financial goals: Investments can help you afford education, a car, or retirement.

- Beating inflation: Returns from investments usually outpace inflation.

- Passive income: Some investments, like dividends or rent, generate income without extra work.

3. The Power of Compounding

Albert Einstein reportedly called compounding the “eighth wonder of the world.” Compounding means your money earns returns, and then those returns themselves start earning returns. Over time, this creates exponential growth.

For example, if you invest ₹10,000 at a 10% annual return:

- After 1 year: ₹11,000

- After 5 years: ₹16,105

- After 10 years: ₹25,937

The longer you invest, the greater the effect of compounding. That’s why starting early is one of the golden rules of investing.

4. Understanding Risk and Return

All investments carry some level of risk. Risk is the possibility of losing money, while return is the profit you expect to make. Generally, higher returns come with higher risks.

- Low-risk investments: Fixed deposits, government bonds (safer, but lower returns).

- High-risk investments: Stocks, cryptocurrencies (can give high returns but also big losses).

The key is to find a balance that matches your financial goals and comfort level. This balance is called your risk tolerance.

5. Diversification: Don’t Put All Eggs in One Basket

Imagine you invest all your money in one company’s stock, and that company fails. You could lose everything. Diversification protects you by spreading investments across different assets.

For example:

- 40% in stocks

- 30% in bonds

- 20% in real estate

- 10% in gold

This way, if one asset performs poorly, others may balance it out. Diversification reduces risk without reducing potential returns too much.

6. Time Horizon: Short Term vs. Long Term

Your investment choices depend on your time horizon—the length of time you plan to invest.

- Short-term goals (1–3 years): Safer options like fixed deposits or debt funds.

- Medium-term goals (3–7 years): Balanced mix of equity and debt.

- Long-term goals (7+ years): Equity-focused investments that grow significantly over time.

The longer your time horizon, the more risk you can usually take, since markets recover from short-term ups and downs.

7. Building the Right Mindset

Investing is not just about money—it’s also about mindset. Many beginners make emotional decisions: buying when markets rise out of excitement, and selling when markets fall out of fear. This often leads to losses.

To succeed, you need:

- Patience: Wealth grows slowly.

- Discipline: Invest regularly, regardless of market ups and downs.

- Knowledge: Keep learning about investments and the economy.

- Clarity: Stay focused on your financial goals.

8. Practical Steps to Start Investing

If you are ready to begin your investment journey, here are some steps:

- Set financial goals – Know why you are investing (retirement, house, education, etc.).

- Build an emergency fund – Keep 3–6 months of expenses in a savings account before investing.

- Clear high-interest debt – Pay off credit card bills or personal loans first.

- Choose the right investment account – For example, a brokerage account or a mutual fund account.

- Start small – Even ₹500 or ₹1,000 per month can grow over time.

- Automate investments – Use SIPs (Systematic Investment Plans) to invest regularly.

- Review regularly – Check progress once or twice a year, not daily.

9. Common Mistakes to Avoid

- Chasing quick profits – Investing is not gambling.

- Timing the market – Nobody can predict exact highs or lows.

- Ignoring fees – High charges in mutual funds or brokers eat into returns.

- Over-diversifying – Having too many investments can reduce focus and returns.

- Stopping investments during market falls – This is actually the best time to buy more at lower prices.

Final Thoughts

The foundation of investing is simple: start early, stay consistent, diversify, and think long term. Investing is not about getting rich overnight—it’s about building steady wealth over time. The earlier you begin, the greater the rewards of compounding.

Remember, you don’t need a large sum of money to start. You just need the willingness to learn, the discipline to invest regularly, and the patience to let your money grow.

Your financial future is in your hands. The best time to start investing was yesterday. The second-best time is today.